Related Articles

Jan 08, 2025

Jan 08, 2025

Is Varicose Vein surgery covered under the health insurance policy in India

Health Insurance

Health Insurance

.png)

Cancer as a disease brings devastation not only to the patient but to the loved ones too. And it is not just the genes that make one susceptible to it; there are other contributing risk factors, making it completely unpredictable. Over the years, research confirms that even the healthiest of individuals are falling prey to this lethal disease. Hence, the need for cancer insurance plans is evident to mitigate the financial burden of treatment and get comprehensive care to give this disease a tough fight.

.png)

Cancer is one of the deadliest diseases, with a skyrocketing treatment cost. Cancer treatment expenses are so exorbitant that ordinary individuals find it challenging to afford them. A cancer health policy is an insurance plan that allows coverage to the policyholder against this lethal disease. Hence, if the insured individual is diagnosed with cancer, the insurer pays out an amount in a lump sum to get the treatment started.

These plans of health insurance for cancer patients allow high coverage at affordable rates if the insured is diagnosed with the illness during the policy tenure. Most cancer care insurance plans are long-term plans that cover an individual for up to 40 to 50 years.

Below are the basic eligibility criteria for most cancer plans in general:

Below are some of the best cancer insurance plans available in India in 2025:

| Plan Name | Entry age | Waiting period | Features | ||||

| HDFC iCan Cancer | 18 years and above | 4 months of initial waiting period from policy inception | Covers modern treatment Covers second opinions Covers follow-up care etc. |

||||

| Care Cancer Mediclaim |

|

|

Annual healthcare Chemo and radiotherapy cover Air ambulance cover etc. |

||||

| Aditya Birla Cancer Secure Insurance |

|

|

Up to 150% of cancer care cover No Claim Bonus Pays in a lump sum |

||||

| New India Cancer Guard Policy | Min. – 3 months

Max. – 65 years |

|

SI up to 50 lakhs Avail cancer care benefit 58 daycare procedures covered etc. |

||||

| Raheja QBE Cancer Insurance |

|

30 days initial waiting period | SI up to INR 10 lakh available Diagnostic investigation covered No exit age feature etc. |

Cancer is not only the deadliest disease of the present times, but it is a disease with the costliest treatment available. Hence, cancer requires special attention and a special cancer policy. Here are some points which make it essential for everyone to stay covered under a cancer plan.

Here are some key differences between cancer and critical illness plans:

| Points of Difference | Cancer Insurance | Critical Illness |

| Meaning | The policy offers a lump sum amount to the insured as per the diagnosis of the cancer | This plan offers a claim amount if diagnosed with a critical illness mentioned under the plan |

| Coverage | Covers cancer of different types | Covers critical illnesses listed under the plan |

| Cancer stages | Covers cancer in all stages | Most plans cover only advanced stages of cancer |

| Policy tenure | Up to 40 years | Up to 50 years |

When buying a health insurance plan, you consider some crucial aspects before purchasing. Similarly, while buying a cancer plan, there are specific points to take note of:

The first thing to consider is the Claim Settlement Ratio of the insurance company because the CSR indicates the number of claims settled by the insurer from the ones that the company received

Each cancer insurance policy might have its unique terms of pay-out depending on the diagnosis stage. Thus, it is important to read the pay-out terms and conditions and choose a plan that suits you best

It is also important to consider the terms of coverage of the cancer insurance plans. The plans that offer longer terms are more favorable as they cover you for a longer tenure

Another significant thing to consider is your premium. It is crucial to choose plans with pocket-friendly and affordable premiums. Look out for plans offered by renowned insurers that give comprehensive coverage at a reasonable premium price

Here are some benefits of investing in a cancer insurance plan:

All such above-mentioned and other benefits are reasons enough for individuals to buy cancer insurance policies and stay covered under such plans.

Since cancer insurance plans are meant explicitly for cancer treatments, they come with specific exclusions such as:

You would be required to submit the below documents to raise a cancer plan claim:

No. Insurance companies generally do not cover a person who is already diagnosed with cancer. However, it varies from company to company. Hence, you can look for the best cancer coverage plan to get better and enhanced coverage.

No, there is no death benefit option under cancer plans in general. However, it depends on the insurance company, so you must read the policy document thoroughly.

Yes, LIC offers coverage against cancer through the LIC Cancer Cover plan, which can be purchased online and offline.

Yes, many government hospitals and medical institutes allow free cancer treatment. One such institute is PGIMER (Postgraduate Institute of Medical Education and Research, Chandigarh). This is one of the best institutes for free cancer treatment in India.

In most cases, regular health insurance plans may or may not cover cancer, depending on the insurance company. However, if you buy a critical insurance plan, you can avail of cancer coverage only at the advanced stage.

However, some specific plans are offered by some insurers like Aviva health insurance that allow Aviva cancer coverage as part of their health package with other core covers.

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Showing care and love towards your loved ones can come in different forms, and purchasing a family health insurance plan is one of them. While there are several benefits of purchasing a family health insurance plan, finding one that suits your family’s needs can be confusing. Let’s walk through the top family health insurance plans to give you an insight.

Health insurance has become a household name in recent years, especially after the worldwide pandemic outbreak. People have understood the importance of having health insurance the hard way. This has significantly enhanced its popularity.

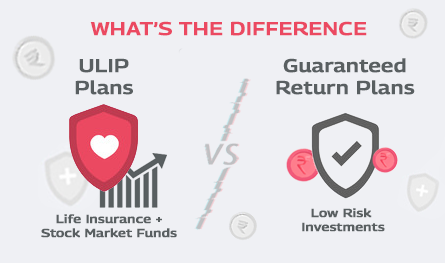

When it comes to financial planning, people often want to choose the best of both worlds: returns and security. If you have been looking for these two elements under one plan, then you would have come across ULIPs and Guaranteed Return Plans. While ULIP plans offer high returns, guaranteed return plans ensure stability and security. Which one is the most suitable for you? That's a topic worth discussing.

.png)

What about investing in a policy that promises the dual benefit of life cover and maturity benefit? That's exactly what an endowment policy does. All you need to do is save regularly to reap a lump-sum maturity benefit. Simultaneously, the policy also provides life cover to the assured. However, financial experts suggest that not every policy can be suitable for every financial goal.

When 29-year-old Shravan Kapoor planned to buy an endowment plan, he was quite sure he would be able to do that in a few minutes. However, when he opened the insurer’s website, he felt lost in the maze of endowment policies. Guaranteed returns, bonuses, maturity benefits, premium paying tenure, etc, all seemed a little too much to handle.