Related Articles

Jan 08, 2025

Jan 08, 2025

Is Varicose Vein surgery covered under the health insurance policy in India

Health Insurance

Health Insurance

Acquiring new parenthood is not only a matter of joy but also that of great responsibility. However, it cannot be solely achieved by love and care. Proper financial support plays a significant role, considering the circumstances. During this vulnerable phase, both the would-be or the new mother and the newborn require expert medical care and support.

Considering all these aspects, having a comprehensive maternity health insurance policy seems like a plausible solution. As the name suggests, a maternity insurance plan has been specially crafted to cater to the specific requirements of the pregnant mother/new mother and the child. Usually, maternity coverage remains excluded from standard health coverage.

A maternity health insurance claim covers the delivery costs, both normal and C-section, depending on the chosen plan terms. Considering the steep medical inflation rate, childbirth can prove to be an extreme financial burden.

To avoid such unpleasant circumstances, it is best to ensure reliable maternity insurance plan coverage support. It usually covers the hospitalisation costs, medicine costs, and delivery charges, according to the plan terms.

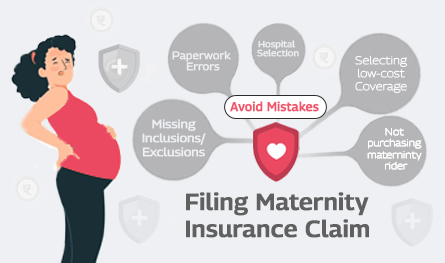

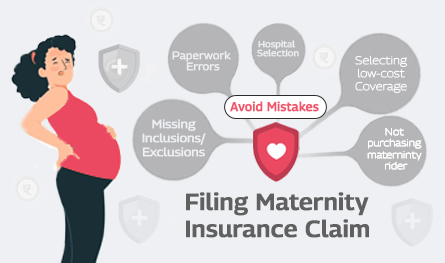

Due to several reasons, maternity insurance claims can get rejected. To ensure a smooth maternity insurance claim settlement, you need to consider the following tips:

Understanding the plan terms is the primary key to optimising your maternity claim benefits. However, you need to consider choosing the most befitting healthcare provider and plan your expenses well beforehand. By taking these proactive steps, you can optimise the maternity insurance claim benefits and enjoy optimum coverage considering the terms of your chosen plan:

Submitting relevant documents on time plays a crucial role in maternity insurance claim settlement. The list of documents that prove to be essential to ensure a smooth and hassle-free maternity claim settlement includes:

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

In a country where medical inflation is rising rapidly, securing a comprehensive health coverage plan for the entire family is no longer optional, it is essential. Selecting the right health insurance requires careful evaluation of multiple factors, not just premium costs. A well-chosen plan ensures financial security, access to quality healthcare, and peace of mind during medical emergencies.

Term insurance is an important investment. However, with the availability of so many insurers offering term plans, it becomes difficult to select the best term plan to suit your needs. Buying a term plan needs some consideration and research on the part of the policyholder. In this post, let us discuss the best term insurance providers in India.

Have you ever caught yourself lost in illusions about your daughter's future events, such as her university convocation and first day at work? Her university convocation. When she embarks upon her initial job after graduation will be the day.

.png)

When you sign up for a life insurance policy - whether it’s a traditional term insurance policy or a ULIP – you are not just buying peace of mind. You are also trusting the insurer with your money. So naturally, you would want to know: How is that money being managed? And more importantly, how is it being protected from risky decisions?

.png)

Globally, 20th October marks the day to observe World Osteoporosis Day. Do you know the significance of observing Osteoporosis on a global platform? Do you know how this condition affects people and their lives? Let us find out in this post!