Related Articles

Jan 08, 2025

Jan 08, 2025

Is Varicose Vein surgery covered under the health insurance policy in India

Health Insurance

Health Insurance

.png)

It is very important to get your comprehensive health checkup before you buy health insurance.

A health insurance policy is supposed to help you get coverage for various expenses that you incur before hospitalization and after the same. Having such a policy means you have to face far less strain on your finances. These policies include check-ups that are done at regular intervals so that various ailments can be detected as soon as possible. The period for which you have to get the check-up done also depends on the insurer from which you have bought the policy. Apart from the regular medical tests, you might have to undergo a health test before you renew such a policy.

.png)

However, please remember that these tests are not mandatory as far as buying health insurance plansare concerned and the insurer could always waive them off. However, if you are older than 45 years you may have to get such a test done before you can buy a health policy. This condition, though, varies marginally depending on the insurer that you are buying the policy from.

People normally buy health policies so that they can protect themselves from the uncertainties of life and delay their deaths as much as they can.

Now, even when you are buying the best health insurance you may already be suffering from an ailment. It is common knowledge that health insurance is so costly that most people find it hard to afford. On top of that, if you are already suffering from a disease when you try to buy such a policy the premium can rise even more sharply making it hard for such people to afford these costs. During the time that you are covered by such a policy you may develop some illness, which could then be covered by the insurer.

The word pre-existing medical condition means a disease that you are already suffering from when you are attempting to buy the best health insurance in India. Now this condition could be an illness or a medical injury. Examples of such pre-existing health issues are the likes of cancer, COPD (chronic obstructive pulmonary disease), diabetes, and depression, to name a few. Normally, the likes of diabetes and hypertension are rather common conditions but even they entail a higher premium.

When an insurance company is selling comprehensive health checkup packages it conducts a medical checkup of the subscriber. This is done mainly by the insurer so that it can find the health risks that are possibly associated with the buyer. This also helps them learn about the illnesses that the person in question is going through. In case you are over 45 years, an insurer could ask you to take such tests. However, this depends on the insurer that you are buying the policy from. The IRDAI (Insurance Regulatory and Development Authority of India) states that the costs of these tests should be divided equally between the buyer and the seller.

Following are the reasons why a full body comprehensive health checkup is important in the context of these policies:

There are several reasons why you should get these tests done before you buy a health insurance policy. First of all, an insurer would only accept the claim when it has total information on your health. It represents a contract of good faith. If you hid any condition while buying the policy and fell ill because of the same your claim would be rejected by the insurer. In that case, it would be well within its rights to do so. This is why it is your responsibility to disclose all the important information over here.

Following are the tests that you should get done when you are trying to buy health insurance plans:

It is common knowledge that you have to get a check-up if you are 45 years and older in these cases – below that it is optional. So, if you are not 45 yet you could always skip these tests. However, getting these tests done could be just as beneficial for you as it could for the insurer.

If you want the best health insurance we suggest that this is something that you do not bypass. We have already said how you can skip them if you are under 45 years. In the case of some insurers, this comes down to 40 years. So, as you can see for yourself, this varies from one insurer to another. Usually, if you want to buy a health plan with coverage of over five lakh rupees you would need to get these tests done.

A yearly or biannual preventative medical check-up is typically covered by the majority of health insurance plans, but the amount can vary from one health plan to the next. In general, health insurance policies do not pay for doctor visits or independent diagnostic health exams.

The heart, lungs, liver, kidneys, pancreas, eyes, and ears are just a few of the body's organs that the Comprehensive Medical Check up Scheme carefully examines. In addition to a thorough physical examination, the tests listed are used to evaluate their health. The option of consultation is available after receiving reports.

Before granting an applicant access to a health insurance plan, a medical examination is necessary to ascertain their medical fitness. To determine whether they are eligible for insurance coverage, people over 40 or 45 must take a pre-policy medical exam.

Although it is not required by the Income Tax Act Department to keep a record of all expenses incurred throughout the year, such as receipts for health insurance premium payments, medical bills, medical expenses, test results, etc., it is advisable to do so.

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Showing care and love towards your loved ones can come in different forms, and purchasing a family health insurance plan is one of them. While there are several benefits of purchasing a family health insurance plan, finding one that suits your family’s needs can be confusing. Let’s walk through the top family health insurance plans to give you an insight.

Health insurance has become a household name in recent years, especially after the worldwide pandemic outbreak. People have understood the importance of having health insurance the hard way. This has significantly enhanced its popularity.

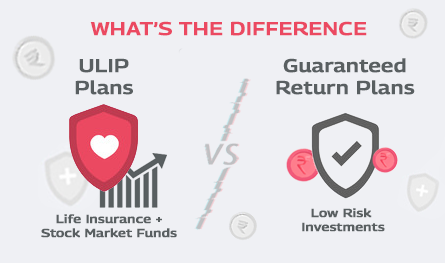

When it comes to financial planning, people often want to choose the best of both worlds: returns and security. If you have been looking for these two elements under one plan, then you would have come across ULIPs and Guaranteed Return Plans. While ULIP plans offer high returns, guaranteed return plans ensure stability and security. Which one is the most suitable for you? That's a topic worth discussing.

.png)

What about investing in a policy that promises the dual benefit of life cover and maturity benefit? That's exactly what an endowment policy does. All you need to do is save regularly to reap a lump-sum maturity benefit. Simultaneously, the policy also provides life cover to the assured. However, financial experts suggest that not every policy can be suitable for every financial goal.

When 29-year-old Shravan Kapoor planned to buy an endowment plan, he was quite sure he would be able to do that in a few minutes. However, when he opened the insurer’s website, he felt lost in the maze of endowment policies. Guaranteed returns, bonuses, maturity benefits, premium paying tenure, etc, all seemed a little too much to handle.