Related Articles

Jan 08, 2025

Jan 08, 2025

Is Varicose Vein surgery covered under the health insurance policy in India

Health Insurance

Health Insurance

Financial security is conventionally offered during medical emergencies through the popular benefit of corporate health insurance that many employers provide employees. However, such insurance becomes ineffective when you leave or retire from the company or switch jobs. People who want to keep health insurance need to change from corporate to individual insurance.

With individual health insurance, you know you’re covered when it comes to unexpected medical costs, keeping your mind at ease. While corporate health insurance provides common coverage, individual plans can be catered according to your specific requirements, with add-ons such as maternity benefits, critical illness coverage or higher coverage limits.

Another benefit is that having your own personal health insurance means you won't be without insurance when moving jobs or when you retire. It also allows for building a consistent claim history that is handy when renewing or upgrading policies. Proactively planning the shift to an individual plan, if you do it in advance, you'll never find yourself without coverage and your healthcare needs will never be compromised regardless of your employment status.

In this blog, we discuss how to migrate from corporate to health insurance for individuals, the various steps involved and the advantages of doing so. Regardless if you want the best health insurance plans or affordable health insurance plans, we have covered it all.

When transitioning from a group health plan to health insurance for individuals, there are several aspects to consider:

As we know, most corporate health insurance policies come with limited coverage and may not include maternity coverage, pre and post-hospitalisation expenses and high-sum insured options. You must evaluate your current policy and see what other add-ons you need to meet your requirements.

The Insurance Regulatory and Development Authority of India (IRDAI) guidelines state that health insurance portability will enable you to carry forward your policy benefits (such as no claim bonus and waiting period) to an individual plan. Make sure that the portability request is done within 45-60 days before the corporate policy is due to end.

If you are selecting an individual plan, consider your medical history, age and the needs of your family. Some plans may also include lifestyle disease coverage which will be crucial for senior citizens.

Compare affordable health insurance plans on trusted platforms like Paybima and choose one offering the best coverage at a competitive premium. Seek out plans with full benefits and exclusion clauses few and short.

Migrating to an individual health insurance plan can be straightforward if you follow these steps:

Inform your employer or the insurance provider about porting options. Getting an individual policy while you still have coverage under a group policy can even have continuity benefits. Many insurers will continue to provide that coverage.

Complete the portability form and submit the form with your medical history records, claim records and your previous policy details. But always keep in mind to complete this step long before your corporate insurance expires.

Select the health insurance plans that fit your specific requirements and research the best ones. See how premiums, inclusions, exclusions and network hospitals stack up.

Provide ID proofs, medical reports (if required) and a portability form. Be sure to get all the paperwork right so there aren’t any delays.

Once you are approved by the insurer, you’ll have to pay the premium to start the policy. Renewal dates are to be kept in mind so that there is no break in coverage.

Switching to health insurance for individual plan offers several benefits:

Once you leave an organisation, corporate insurance policies are terminated automatically. Moving to an individual plan means you never have a coverage gap.

Individual health plans let you say how much sum insured you want, add add-ons, or choose specific benefits like critical illness coverage or maternity benefits. That way, you know your health coverage is specific to you.

Unlike group plans, most individual policies include a lifetime renewability option which allows individuals to continue to have health coverage even as they reach their senior years.

Benefits like no claim bonuses and reduced waiting periods are carried over to the new plan, along with continuity and minimising your financial liability.

On an individual plan, you are responsible for managing your policies, renewals and add-ons yourself instead of your employer.

Choosing the right health coverage for individuals requires a lot of research. Here are some tips to guide your decision:

Search for online tools that allow you to compare affordable health insurance plans and premiums, coverage, co-pay clauses and hospital networks. It helps you to find plans with the most benefits at the most adorable premiums.

This should also include hospitalisation expenses, daycare procedures, pre and post-hospitalisation costs, and critical illnesses. Check the policy’s terms and conditions.

Make sure to check the insurer’s claim settlement ratio, customer reviews and overall service track record. A reliable insurer also means you do not have to bother with claim processing.

However, if you have dependents, a family floater plan is the best choice. It covers the health of the individuals in your family under a single policy.

Search for plans that have wellness programs, free health checkups and bonuses without claims benefits. These can add value to your policy.

Most insurers allow you to port your corporate policy to an individual plan. This has to happen within the portability window, i.e. 45–60 days before the corporate policy lapses.

Corporate health insurance isn’t tied to your employment, no. The policy usually ends when you leave the job. But you can move to individual health insurance for ongoing coverage.

Indeed, the IRDAI guidelines allow health insurance policies to be ported from one insurer to another. Make sure to apply for portability and meet the new insurer’s requirement with the portability window

The disadvantages of portability are the discontinuity benefits, higher premiums in some cases, less flexibility to customise the premium and denial on grounds of non-compliance with the terms of the insurer.

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Showing care and love towards your loved ones can come in different forms, and purchasing a family health insurance plan is one of them. While there are several benefits of purchasing a family health insurance plan, finding one that suits your family’s needs can be confusing. Let’s walk through the top family health insurance plans to give you an insight.

Health insurance has become a household name in recent years, especially after the worldwide pandemic outbreak. People have understood the importance of having health insurance the hard way. This has significantly enhanced its popularity.

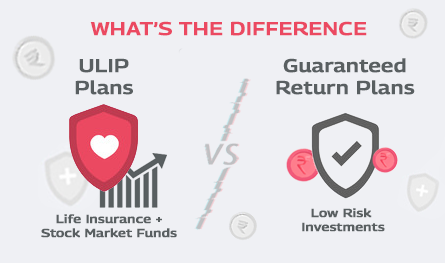

When it comes to financial planning, people often want to choose the best of both worlds: returns and security. If you have been looking for these two elements under one plan, then you would have come across ULIPs and Guaranteed Return Plans. While ULIP plans offer high returns, guaranteed return plans ensure stability and security. Which one is the most suitable for you? That's a topic worth discussing.

.png)

What about investing in a policy that promises the dual benefit of life cover and maturity benefit? That's exactly what an endowment policy does. All you need to do is save regularly to reap a lump-sum maturity benefit. Simultaneously, the policy also provides life cover to the assured. However, financial experts suggest that not every policy can be suitable for every financial goal.

When 29-year-old Shravan Kapoor planned to buy an endowment plan, he was quite sure he would be able to do that in a few minutes. However, when he opened the insurer’s website, he felt lost in the maze of endowment policies. Guaranteed returns, bonuses, maturity benefits, premium paying tenure, etc, all seemed a little too much to handle.