Related Articles

Jan 08, 2025

Jan 08, 2025

Is Varicose Vein surgery covered under the health insurance policy in India

Health Insurance

Health Insurance

Nobody can surely predict the future, but reliable health insurance can protect it well for sure. Uncertainty is the very essence of life; the 2020 pandemic outbreak has taught it the hard way. Securing your and your family’s health is a matter of responsibility and concern rather than that of luxury.

Health insurance acts as a protective shield for you and your family members, offering financial protection against medical emergencies. Considering the steep inflation rate in the healthcare sector, a few days of hospitalisation is enough to deplete a significant portion of your savings, especially if it involves a surgical procedure of any sort.

However, the journey towards buying a competent health plan may seem a bit overwhelming, especially for first-timers. But the Paybima team is determined to make your journey as smooth as possible from the very start.

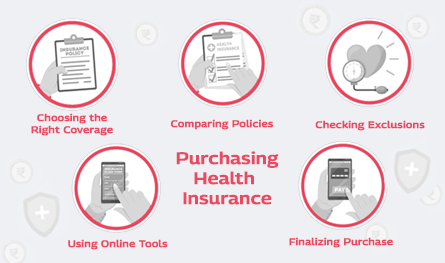

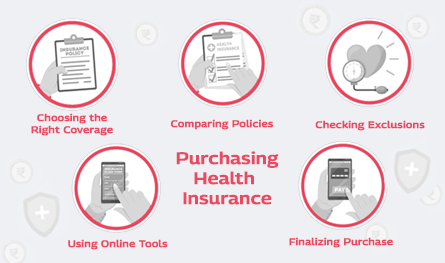

If you follow this comprehensive guide, you can easily buy health insurance in the most hassle-free manner:

The primary target of health insurance is to ensure a smooth hospitalisation and treatment process. Before buying, you must critically analyse your requirements well. Do I need PED coverage or maternity protection cover? Is there any recurrent hereditary ailment running in my family? Ask these questions to yourself first before proceeding.

Regarding the plan variant, you have the following:

Coverage: Ideally, your health insurance coverage must be 6 times your current monthly income. However, this is not mandatory; your necessities will be your primary determinant.

Tip: Your Paybima advisor can guide you to make a clear assessment of your needs and help you select the most suitable health plan.

This is a very critical step to understand the market scenario well and make an informed decision. The important factors that you must consider:

Coverage offered: This involves 4 critical factors to ensure a smooth journey:

Waiting period: This is the hibernation period where you cannot raise or settle any claim for costs incurred for treating certain specific ailments within that tenure mentioned in the plan. There are 3 types of waiting periods:

Co-payment clause: Certain health plans come with a co-payment clause, where you need to settle a part of the total claim amount while the remaining amount will be settled by your insurer. This ratio varies with plan and company. Try to seek a plan with a lower co-payment clause.

Sub-limit: A health plan may come with restrictions on certain specific illnesses/facilities/procedures. Clarify the details before finalising.

Tip: This is a critical procedure to ensure the most suitable policy. Paybima advisors are dedicated to navigating these avenues to help get the best policy.

Not even the best health plan will offer 100% coverage protection under any circumstances. Although the list of exclusions varies with every plan and insurer concerned, certain common exclusions include:

STDs

Apart from these, certain plans exclusively restrict coverage for certain typical ailments/procedures. You must clarify these details before the final selection.

Tip: Considering your circumstances, Paybima advisors will lead you in choosing the most suitable health policy.

Nowadays, you can easily use handy digital tools like premium calculators. You simply enter the necessary details, and it will reveal the probable premium payable amount, helping you prepare a healthy financial portfolio.

Tip: You can do it or request Paybima experts to perform it on your behalf.

After careful research and comparative study, you can zero in on your chosen plan to complete the purchase.

Tip: Following this process, you can ensure a smooth purchase, more so if you have Paybima support.

This is another crucial factor to consider before finalising your purchase, as the primary aim for any insurance lies in claim settlement. You must consider:

Tip: Paybima’s expert guidance will help you enjoy a smooth sail.

You can easily visit the Paybima portal and choose the health insurance from the available options:

You can also visit the nearest Paybima office for in-person consultation.

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

In a country where medical inflation is rising rapidly, securing a comprehensive health coverage plan for the entire family is no longer optional, it is essential. Selecting the right health insurance requires careful evaluation of multiple factors, not just premium costs. A well-chosen plan ensures financial security, access to quality healthcare, and peace of mind during medical emergencies.

Term insurance is an important investment. However, with the availability of so many insurers offering term plans, it becomes difficult to select the best term plan to suit your needs. Buying a term plan needs some consideration and research on the part of the policyholder. In this post, let us discuss the best term insurance providers in India.

Have you ever caught yourself lost in illusions about your daughter's future events, such as her university convocation and first day at work? Her university convocation. When she embarks upon her initial job after graduation will be the day.

.png)

When you sign up for a life insurance policy - whether it’s a traditional term insurance policy or a ULIP – you are not just buying peace of mind. You are also trusting the insurer with your money. So naturally, you would want to know: How is that money being managed? And more importantly, how is it being protected from risky decisions?

.png)

Globally, 20th October marks the day to observe World Osteoporosis Day. Do you know the significance of observing Osteoporosis on a global platform? Do you know how this condition affects people and their lives? Let us find out in this post!