The Power of AI in Claim Processing

Motor insurance claims in the past required extensive paperwork and followed a manual verification process. This method stimulated delays in processing while permitting human errors to enter the system. AI systems have automated various time-consuming manual tasks that used to take weeks to complete.

The combination of algorithms allows rapid document verification to check for proper claim details during processing. AI technology decreases human involvement and speeds up the complete processing while minimising errors.

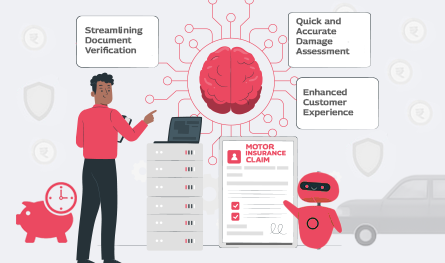

Streamlining Document Verification

The field where AI demonstrates exceptional capability is document verification. The system performs automatic document verification by analysing images, receipts, and other supporting documents that arrive with a claim submission.

The system retrieves essential information from documents, conducts thorough checks, and detects any inconsistencies that may need extra examination. The fast verification system reduces processing times, allowing claimants to obtain approval of their applications instantly.

Quick and Accurate Damage Assessment

AI technology provides quick vehicle damage assessments. It is recognised as one of its main advantages in motor insurance claims examination. AI tools employ sophisticated image recognition methods to analyse vehicle damage photos which helps determine repair expenses.

The quick assessment process helps insurers issue faster claim approvals, enabling policyholders to obtain necessary financial help without enduring long delays. AI evaluation processes deliver consistent and accurate results to maintain fair and quick handling of every claim.

Enhanced Customer Experience

The faster claim processing times create superior satisfaction for policyholders. The elimination of extended waiting times allows policyholders to avoid stressful moments. A faster settlement time enables customers to obtain instant vehicle repairs, resulting in earlier road availability.

Through its transparent tracking system, AI builds trust between insurance providers and their customers. Policyholders experience increased confidence in the insurance service as they receive transparent explanations about claim decisions and faster processing times.

Industry-Wide Impact

The implementation of artificial intelligence in motor insurance serves multiple purposes and is not just limited to quick claim processing. It essentially represents a fundamental shift in insurance sector digitalisation.

The adoption of these technologies by insurers enables operational efficiency and decreased administrative costs, allowing them to provide policyholders with more affordable premium rates. Standardisation from AI-driven procedures produces consistent claim results, benefitting policyholders and insurance providers.

Looking to the Future

Motor insurance claims processing times have shortened significantly with the introduction of AI. It bears testament to a transformative period for the industry that is more focused on efficiency. The integration of these technologies by major companies sets new innovation standards in the industry, enhancing both user experience and service responsiveness in insurance services. AI will transform customer expectations through its emphasis on speed and accuracy while enhancing service transparency to establish new performance standards.

.png)

.png)