4 Types of insurance in India that will protect you financially in 2023

What are the types of insurance policies that are considered most important for an individual to protect him/her and the family members financially. Let’s learn about them in this blog.

Uncertainties can befall us anytime and in any form. We don’t have any hold on them, nor can we stop them from taking place. But we surely can do one thing. We can protect ourselves and our near and dear ones from the financial breakdown which might emerge due to such uncertainties. So, despite the fact that we can’t avoid the unforeseen from taking place, we can still control the situation by avoiding the monetary crisis that the unforeseen situation might cause us.

Hence, the role of insurance has come up. There are many types of insurance plans available to take care of the many different needs of people. However, nobody would like to spend an exorbitant amount on insurance. Thus, it is important to select the right policy available at the right price and as per your precise requirement.

Further, it is also important to note that selecting the right kind of policy at a particular premium is based on varied factors, like;

- The number of children you have.

- Your age

- Your lifestyle or living standard

- Your Job etc.

Visual Stories by PayBima

Based on all such factors discussed above, it can be said that there are four different types of insurance that are generally recommended by financial experts that people should have. They are – Life Insurance, Health Insurance, Disability insurance, and Vehicle Insurance.

Life Insurance

It is the most critical type of insurance policy that secures a family in the event of the sudden death of the head of the family or the main earning member due to any unexpected reason. This insurance policy is important for such families where the entire family depends on the salary of the policyholder.

As per insurance experts, individuals should go for a policy that pays over 10 times the yearly income you are earning at the moment. However, the fact is all policy seekers cannot afford to pay such a cost. Thus, while you are estimating the sum insured of your life insurance policy, you must calculate the expenses of your family, how much do you think they might require for their livelihood after you are gone. Also, you should consider things like loan payments (if any), or any debt, education of children, higher studies, marriage and so on. Further, you must also consider the other sources of income that the family has, (if any).

There are various types of life insurance policies available including whole life insurance plans and term life insurance plans and different types of claims in life insurance. However, buying the right amount of life insurance is important.

Whole life insurance plans are used in two ways – as income tools and as insurance products. These policies cover an individual for the whole life if he/she keeps paying the monthly premiums on time. On the other hand, the Term life policies cover the insured for a particular period of time.

Further, there are several other differences that need to be considered like age, job, number of children, etc., before buying the best term insurance plan. And that is why it is advised to consult an expert or a person with sound knowledge of insurance before buying a policy.

Health Insurance

Having a medical insurance policy has become the most essential thing for each and every person in the current situation. With comprehensive health insurance plans, one can maintain regular annual health check-ups and take care of ailments. At the same time, they also allow people to avoid the massive healthcare bills in case of an accident or a critical disease. Thus, it supports people on tight budgets to gain proper medical support.

Disability Insurance

Let us first define what is insurance of disability? This is a kind of insurance policy that is not considered by most people. But in terms of the importance of insurance, this policy supports the working class who work in industries etc., and who are prone to accidents or disability of any kind. With disability insurance, people can cover the sustenance of their family while they are unable to work. This insurance policy is available for short term as well as long term periods. While buying disability insurance, you must consider that the policy allows enough coverage to maintain the requirements of your family. Age of the insured, his/her lifestyle, as well as health conditions are some such factors which determine an appropriate amount of life and disability insurance.

Vehicle Insurance

Considering the kind of accidents that take place on the Indian roads, comprehensive vehicle insurance is the prime requirement of every vehicle owner. As such, thousands of people die every year due to accidents. Further, it is also mandatory for a vehicle owner to have a third-party insurance to drive on the Indian roads. Hence, this is another key insurance policy that an individual must have.

With auto insurance, you can cover yourself against liabilities to the third-party that appear as a result of accidents on the road. Further, it protects a car/bike against other damages and theft along with saving from causes like vandalism, natural disasters and so on.

Author Bio

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Other Life Insurance Products

Latest Post

Showing care and love towards your loved ones can come in different forms, and purchasing a family health insurance plan is one of them. While there are several benefits of purchasing a family health insurance plan, finding one that suits your family’s needs can be confusing. Let’s walk through the top family health insurance plans to give you an insight.

Health insurance has become a household name in recent years, especially after the worldwide pandemic outbreak. People have understood the importance of having health insurance the hard way. This has significantly enhanced its popularity.

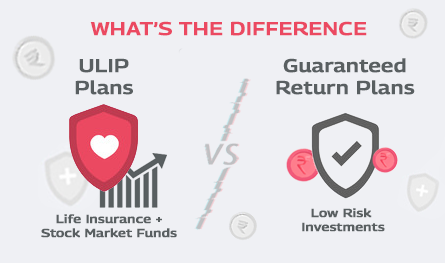

When it comes to financial planning, people often want to choose the best of both worlds: returns and security. If you have been looking for these two elements under one plan, then you would have come across ULIPs and Guaranteed Return Plans. While ULIP plans offer high returns, guaranteed return plans ensure stability and security. Which one is the most suitable for you? That's a topic worth discussing.

.png)

What about investing in a policy that promises the dual benefit of life cover and maturity benefit? That's exactly what an endowment policy does. All you need to do is save regularly to reap a lump-sum maturity benefit. Simultaneously, the policy also provides life cover to the assured. However, financial experts suggest that not every policy can be suitable for every financial goal.

When 29-year-old Shravan Kapoor planned to buy an endowment plan, he was quite sure he would be able to do that in a few minutes. However, when he opened the insurer’s website, he felt lost in the maze of endowment policies. Guaranteed returns, bonuses, maturity benefits, premium paying tenure, etc, all seemed a little too much to handle.