Best LIC Policy: Compare and Choose the Ideal Policy

Buying a policy can be a little tricky, especially if you are planning to invest for the first time. Well, in that case, the best option to go for is Life Insurance Corporation of India. The most important reason why you should go for LIC is that it is government-backed; thus, is considered by many Indians to be more secure. And while we talk about the corporation, let us discuss the best LIC policy for investment.

Here are some of the LIC policy for maximum returns. Keep reading to know about them.

Best LIC Policy for Maximum Returns

| LIC Policies |

|

|

|

|

|

|||||

| LIC SIIP Plan |

|

90days(completed)-65 years | 85 years |

|

7 to 10 times the annual premium | |||||

|

|

90days(completed)-60 years | 75 years | 15-20 years | Min- Rs.1,00,000 Max- No upper limit | |||||

| LIC Jeevan Labh | Traditional savings plan | 8 years-59 years | 75 years | 16, 21, or 25 years | Min-Rs.2,00,000 Max- No upper Limit | |||||

| LIC Jeevan Umang |

|

|

|

100 years minus(-) the age at entry |

|

|||||

| LIC Bima Ratna | Money Back Policy |

|

|

15, 20, or 25 years | Min-Rs.5,00,000 Maximum- No upper limit | |||||

| LIC Money Back 25 years | Money Back Policy | 13 years-45 years |

|

25 years | Min-Rs.1,00,000 Maximum- No upper limit | |||||

|

Endowment Plan |

|

|

|

Min-Rs.1,00,000 Maximum- No upper limit | |||||

| LIC New Jeevan Shanti |

|

Min – 30 years

Max – 79 years |

Min – 31 years

Max – 80 years |

Min – 5 years

Max – 15 years |

Min – INR 1.5 lakh Max – No Limit |

|||||

|

Individual pension plan | Min – 18 years

Max – 75 years |

Min – 35 years

Max – 85 years |

Min – 10 years

Max – 42 years |

Min – No limit Max – No Limit |

|||||

|

Pure protection plan | Min – 18 years

Max – 65 years |

|

Min – 10 years

Max – 40 years |

Min – INR 25 lakhs

Max – No limit |

Now, let us delve deeper to know a few of these plans at length.

1. LIC SIIP Plan

It is a unit-linked insurance plan and along with insurance protection, you will also be able to create a corpus. If you are wondering why this is considered the best LIC policy for maximum return, then here are the reasons mentioned below:

Features of LIC SIIP Plan:

- There are four fund options and you can choose the one that suits your risk-appetite

- If the one you chose is not performing as per your expectations, you can switch without spending a penny

- In case of urgent need of money, you can withdraw a certain amount

- Under Section 80C and 10(10D) of the Income Tax Act,1961, you will be able to save taxes

- You get the death benefit, maturity benefit, and rider benefit with this plan.

Eligibility criteria for LIC SIIP Plan:

| Entry Age | Maturity Age | Sum Assured |

|

|||

|

90 days(completed) | 18 years | 7 times the annual premium |

|

||

| Maximum | 65 years | 85 years | 10 times the annual premium |

|

2. LIC Bima Jyoti Plan

With this policy, you will not only be able to stay protected under life insurance but can also systematically save money.

Features of LIC Bima Jyoti Plan:

- You will have the freedom to choose from the policy terms and sum assured

- At the end of each policy year, you will have guaranteed additions to the sum assured

- Instead of the lump sum, you will have the option to receive the maturity amount in installments and the nominees of the policy can get death benefits in installments

- At your convenience, you would be able to pay the premiums either monthly, quarterly, half-yearly, or annually

- You will get the death benefit, maturity benefit, and rider benefits such as LIC’s Accidental Death and Disability Benefit Rider such as LIC’s Accident Benefit Rider, LIC’s New Term Assurance Rider, LIC’s New Critical Illness Benefit Rider, LIC’s Premium Waiver Benefit Rider.

Eligibility criteria for LIC Bima Jyoti Plan:

| Entry Age |

|

|

Policy Term |

|

|||||

| Minimum | 90 days(completed) |

|

INR 1,00,000/- |

|

Policy term minus 5 years | ||||

|

|

|

No limit |

|

3. LIC Jeevan Labh

This is yet another best insurance policies in India with high returns. In case of an unfortunate event, the family of the policyholder will get financial security. And if the policyholder survives, he/she will get the maturity benefit and also a revisionary bonus as well as a final additional bonus.

Features of LIC Jeevan Labh:

- You will be able to choose from policy terms such as 16, 21, or 25 years

- You are likely to get bonuses that LIC will be declared based on the profit of the corporation in a year

- You will pay premiums for a certain period while can enjoy benefits and coverage

- If the sum assured is more than INR 5 Lakh, you will get discounts on the premiums

- Along with death benefits and maturity benefits, you will get rider benefits such as Accidental Benefit Rider, Accidental Death and Disability Benefit Rider, Term Assurance Rider, Critical Illness Rider, and Premium Waiver Benefit.

Eligibility Criteria for LIC Jeevan Labh:

| Entry Age |

|

|

Policy Term |

|

||||

| Minimum | 8 years | N/A | INR 2,00,000/- |

|

10, 15, or 16 years | |||

|

59 years |

|

No limit |

4. LIC Jeevan Umang

LIC Jeevan Umang is a dual-benefit plan that comes with the option of income and savings to secure the future of your family. It allows whole-life coverage as well as the benefit of annual survival for the policyholder.

Features of LIC Jeevan Umang

- The plan allows the nominee to claim the death benefit amount in installments

- The plan offers several riders to enhance coverage

- The premium of the plan can be paid regularly as monthly deductions from the bank account during the policy payment term

- Policyholder can avail tax benefits u/s 80C and 10(10D) of the Income Tax Act

Eligibility criteria for LIC Jeevan Umang

| Entry age | Maturity age | Sum assured | Policy term | Premium paying term | ||

|

90 days | – | INR 2 lakh | 15 years | 15/20/25/30 years | |

| Maximum | 55 years | 100 years | No Limit | 30 years |

|

5. LIC Bima Ratna

Being a non-participating and non-linked policy, Bima Ratna from LIC offers pure coverage to the insured against his/her sudden death. The nominee of the policy can avail of death benefits and if the policyholder outlives the plan, he/she is entitled to enjoy survival benefits.

Features of LIC Bima Ratna

- The plan comes with guaranteed additions with maturity or death benefits that increase the final payout amount

- The insured/nominee can choose to receive the maturity/death benefit as lump sum pay or in installments

- Premiums can be paid either monthly/quarterly/half-yearly/annually as per the convenience of the insured

- Policyholders can receive discounts on premiums by choosing annual or half-yearly payment terms for premium

Eligibility criteria for LIC Bima Ratna

| Entry age | Maturity age | Sum assured | Policy term | Premium paying term | ||||

|

5 years for 15 years policy term, 90 days each for 20 years and 25 years policy term |

20 years (for 15- and 20-years policy), and

25 years (for 25-years policy) |

|

15 years |

|

|||

| Maximum | 55 years for 15 years policy term, 50 years for 20 years policy term, and 45 years for 25 years policy term |

70 years (for all policy terms) | No Limit | 25 years | 11/16/21 years |

6. LIC Money Back 25 years

This is a non-linked, participating life insurance policy which is a great combination of protection and savings. Not only does the policy allow security against death in the form of the death benefit, but it also offers periodic survival benefits at particular durations during the policy term. The plan also helps policyholders manage the liquidity needs of people by offering loan facilities.

Features of LIC Money Back 25 years:

- This is a traditional endowment participating plan

- This is an effective money-back plan that comes with the benefit of bonus

- If the policyholder survives through the plan, he/she can receive survival benefits at the end of the 5th, 10th, 15th, and 20th years.

Eligibility criteria for LIC Money Back

| Entry age | Maturity age | Sum assured | Policy term | Premium paying term | |||||

|

|

Not applicable |

|

25 years |

|

||||

| Maximum | 45 years |

70 years | No Limit | – | – |

7. LIC New Jeevan Anand

This is another excellent LIC plan that allows monetary security to the beneficiary of the plan in the event of an unfortunate demise of the policyholder. The plan also offers maturity benefits if the insured outlives the term of the policy. Further, New Jeevan Anand presents a loan facility in the event of a monetary emergency.

Features of LIC New Jeevan Anand:

- The plan comes with a premium payment discount for customers

- Rebates on payment of premiums are also available

- It comes with riders like accidental death and disability rider

- Offers tax benefit to the insured

Eligibility criteria for LIC Jeevan Anand

| Entry age | Maturity age | Sum assured | Policy term | Premium paying term | ||||

|

|

Not applicable |

|

15 years | 15 – 35 years | |||

| Maximum | 50 years |

75 years | No Limit | 35 years | – |

8. LIC New Jeevan Shanti

This is a deferred annuity plan that can be availed by paying a single premium. Under this plan, the insured has to pay the premium in a lump sum amount to avail of plan coverage. Moreover, the policyholder can opt between a single-life deferred annuity or a joint-life deferred annuity plan.

Features of LIC New Jeevan Shanti:

- The plan is flexible in terms of premium payout frequency. The insured can choose to pay the premium monthly, quarterly, half-yearly, or annually.

- The plan comes with several riders that can be availed by the insured for improved coverage

- The policy allows tax benefits u/s 80C and 10(10D) of the IT Act

Eligibility criteria for LIC Jeevan Umang

| Entry age | Maturity age | Sum assured | Policy term | Premium paying term | ||||

|

|

31 years |

|

5 years | 5/10/15 years | |||

| Maximum | 79 years |

80 years | No Limit | 15 years | 5/10/15 years |

9. LIC New Pension Plus

This is a ULIP plan crafted to support policyholders to accumulate corpus using systematic savings. The savings can be used later to receive a regular pension amount after retirement. The policyholder can invest in the plan by paying regular premiums throughout the term of the policy or they can choose to pay the premium amount in a single go as a lump sum amount.

Features of LIC New Pension Plus

- The plan allows the investors to avail of a regular pension income which is accumulated during the term of the plan

- It also offers the flexibility to choose one of the 4 available fund options

- Tax benefits can be availed u/s 80C and 10(10D) of the IT Act

Eligibility Criteria for LIC New Pension Plus

| Entry age | Maturity age | Sum assured | Policy term | Premium paying term | |||||

|

|

35 years |

|

10 years |

|

||||

| Maximum | 75 years |

85 years | Nil | 42 years |

|

10. LIC Jeevan Amar

Jeevan Amar is a pure-term plan by LIC, which doesn’t include any survival, maturity, or other benefit for the insured. However, the policy provides monetary benefits to the insured in the case of the sudden demise of the insured.

Features:

- This is a plan that is not linked to any market risks.

- The plan offers the option of increasing the sum assured

- The premium is charged in terms of two categories – for smokers and non-smokers

Eligibility criteria for LIC Jeevan Umang

| Entry age | Maturity age | Sum assured | Policy term | Premium paying term | |||||

|

|

65 years |

|

10 years |

|

||||

| Maximum | 65 years |

80 years | No limit | 40 years | Regular, limited, or single |

Why Choose LIC To Buy a Life Insurance Plan?

A life insurance policy is an important investment for people who want to secure the lives of their loved ones. There are several reasons to choose LIC to buy a life insurance plan. Some of them are as follows:

- LIC is a reliable insurance provider as it is a government-backed insurance company that gives a sense of security to the policyholders

- They allow policyholders to buy insurance plans at affordable premiums

- LIC policies can be easily purchased via online and offline mode

- Most policies of LIC offer loan facilities up to a certain percentage of the sum assured

- Policyholders can add riders to enhance LIC policy coverage

- They are also eligible for tax benefits under section 80C of income tax for up to 1.5 lakhs

How to Purchase an LIC Plan?

LIC plans are easily available for purchase through online and offline modes. For the comfort of their customers, LIC has started an online initiative to sell policies easily and effectively. Interested applicants can choose the best LIC plans sitting in the comfort of their homes eliminating the physical visit to the branches.

LIC policies are also available through LIC agents spread across the country. They guide the applicants in the buying process and help them choose a good policy to suit their needs. The agents are like personal guides or counselors for policyholders updating them about the policies now and then. Besides, applicants can also buy LIC plans from the LIC branches by visiting the nearest branch personally.

Best LIC Plans & Policies with Higher Returns, 2024

There are several LIC policies that you can opt for to get high returns. Some of them are LIC SIIP Plan, LIC Bima Jyoti Plan, LIC Jeevan Labh, LIC Jeevan Umang, LIC Bima Ratna, LIC New Jeevan Anand, LIC Money Back 25 years, etc

LIC policies are good for those who are risk-averse. With LIC policies, you will get coverage that can be helpful for the future of your family.

Buying a LIC policy towards the end of the fiscal year, i.e. March, is considered to be good.

Yes, LIC offers a bonus on the policy each year; however, it is subject to surplus. To calculate the yearly bonus, you can use the LIC bonus calculator.

Author Bio

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Other Life Insurance Products

Latest Post

Showing care and love towards your loved ones can come in different forms, and purchasing a family health insurance plan is one of them. While there are several benefits of purchasing a family health insurance plan, finding one that suits your family’s needs can be confusing. Let’s walk through the top family health insurance plans to give you an insight.

Health insurance has become a household name in recent years, especially after the worldwide pandemic outbreak. People have understood the importance of having health insurance the hard way. This has significantly enhanced its popularity.

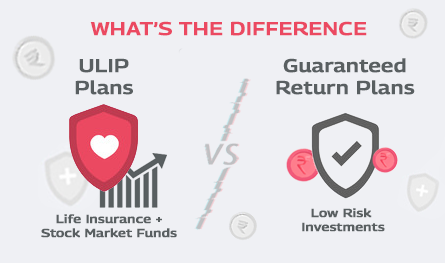

When it comes to financial planning, people often want to choose the best of both worlds: returns and security. If you have been looking for these two elements under one plan, then you would have come across ULIPs and Guaranteed Return Plans. While ULIP plans offer high returns, guaranteed return plans ensure stability and security. Which one is the most suitable for you? That's a topic worth discussing.

.png)

What about investing in a policy that promises the dual benefit of life cover and maturity benefit? That's exactly what an endowment policy does. All you need to do is save regularly to reap a lump-sum maturity benefit. Simultaneously, the policy also provides life cover to the assured. However, financial experts suggest that not every policy can be suitable for every financial goal.

When 29-year-old Shravan Kapoor planned to buy an endowment plan, he was quite sure he would be able to do that in a few minutes. However, when he opened the insurer’s website, he felt lost in the maze of endowment policies. Guaranteed returns, bonuses, maturity benefits, premium paying tenure, etc, all seemed a little too much to handle.