FD Premature Withdrawal Penalty Calculator 2024

Calculators are used to calculate premiums, interest rates and other important aspects related to insurance and investments. Let us take a look at the FD premature withdrawal penalty calculator 2024 for better understanding.

- What is Premature Withdrawal of FD?

- Difference Between Simple Interest and Compound Interest

- Advantages and Benefits of FD Premature Withdrawal Penalty Calculator

- How Can FD Premature Withdrawal Penalty Calculator Help?

- How Does the Fixed Deposit Premature Withdrawal Penalty Calculator Work?

- How Does a Bank Impose Penalty Charges on Premature FD Withdrawal?

- How do banks and financial institutions penalize investors for Premature FD Withdrawal?

- The Process to Close an FD Prematurely

What is Premature Withdrawal of FD?

If an FD account holder plans to withdraw the account prematurely, the withdrawal of the investment before completing maturity is called FD premature withdrawal or breaking the FD.

Banks and financial institutions offering FDs allow investors to get premature withdrawal facility. Hence, you can easily withdraw FDs when you need money. However, you must remember that doing so would levy a penalty on the interest amount ranging between 0.5% and 1%.

Difference Between Simple Interest and Compound Interest

Now, since the penalty on FD premature withdrawal is imposed on the FD interest amount, it is subtracted from the booked interest to keep the rate of interest low. This lowered rate of interest is then used to calculate the final maturity amount of the FD and it is calculated in terms of simple interest or compound interest.

Thus, the investor can gain interest on the amount invested based on simple interest. Simple interest is calculated as SI = PTR/100.

Here,

- ‘P’ means principal amount,

- ‘T’ implies tenure, and

- ‘R’ means interest rate (reduced interest rate in this case)

But, in case of compound interest, the investor avails interest on the primary amount of the FD as well as the accrued interest.

In case of FD premature withdrawal penalty, the amount is calculated based on compound interest. The formula for the same is;

A=P (1+r/n) *n*t

Here,

- ‘A’ means final maturity amount,

- ‘P’ means principal amount,

- ‘r’ implies interest rate (reduced),

- ‘t’ means tenure,

- ‘n’ connotes compound interest frequency and

- ‘I’ means interest earned.

Advantages and Benefits of FD Premature Withdrawal Penalty Calculator

Here are some advantages of the FD premature withdrawal penalty calculator:

- The calculator helps in evaluating the exact penalty rate as well as the final maturity amount to be received

- Being a mechanical device, there are hardly any chances of human errors in the calculator

- You can easily calculate from the comfort of your home by using the FD maturity calculator and there is no need to visit your bank

How Can FD Premature Withdrawal Penalty Calculator Help?

The FD premature withdrawal penalty calculator helps in numerous ways:

- The calculator helps in estimating the penalty levied for prematurely withdrawing the FD amount. The penalty, however, is imposed on the interest that the bank pays to the investor

- The calculator also offer details on how much penalty is imposed on the investor for withdrawing FD prematurely

- Moreover, it also calculates the interest that is lowered on the withdrawal amount

Thus, by using the calculator, it becomes easy for the depositor to evaluate the penalty amount for a premature withdrawal of fixed deposit. This way, they come to know about the exact penalty that is levied and also know the interest that is lowered. Hence, they can check for the disadvantages (in case any) of withdrawing FD prematurely.

Further, the calculator also helps the investor to analyse the returns to be received at the time of withdrawal. They can also get to know the amount of loss they are about to incur due to the penalty. If the loss they are about to incur due to premature withdrawal is too much, they may keep their FD withdrawal plans on hold.

How Does the Fixed Deposit Premature Withdrawal Penalty Calculator Work?

The calculator is used to evaluate the penalty amount imposed on the investor for premature closure of FD. We already know that the penalty that is levied on the investor is actually imposed on the interest earned on the FD. Hence, the calculator can be used to compare the penalty levied by different banks to help the investor understand the scenario better.

Now, despite the penalty if an investor goes ahead with withdrawing the amount prematurely, the interest rate of the FD is reduced from the rate at which the FD was started or the booked interest rate. However, the bank will not pay any interest to the investor if they prematurely withdraw the money before the minimum period stated under the terms and conditions of the bank.

As far as the bank is concerned, they calculate the withdrawal penalty in two different ways. Let’s check the two ways below, assuming that the penalty or fixed deposit breaking charges levied by the bank is 1%.

Case 1:

Assume that the FD amount is INR 1 lakh, rate of interest is 7% and the tenure of FD is 2 years. 6.5% is the supposed interest rate for 1 year here. Now, the investor withdraws the FD after completion of 1 year. In this case, even if the person has earned an interest rate of 7%, the bank will redo the interest calculation at revised rates with a 1% penalty to be deducted. So, the new rates will be 6.5% – 1% = 5.5%. Thus, rather than 7%, the investor will be paid the interest at 5.5%.

| Parameters | Details | ||

| Principle Amount | INR 1 lakh | ||

|

7% /annum | ||

| Maturity amount after completing 1 year | INR 1,07, 186 | ||

| One year interest rate | 6.5%/annum | ||

| Effective interest rate | 6.5%/annum | ||

| Penalty charge | 1% | ||

|

5.5% | ||

| Amount received at the time of premature withdrawal |

|

Case 2:

Assume that the FD amount is INR 1 lakh, rate of interest is 6% and the tenure of FD is 2 years. 7% is the supposed interest rate for 1 year here and penalty levied is 1%. Now, the effective rate of interest is the reduced rate at which the amount was booked or the rate for which the FD was active in the bank.

Now, if the investor withdraws the FD after completion of 1 year. In this case, even if the person has earned an interest rate of 6%, the bank will redo the interest calculation at revised rates with a 1% penalty to be deducted. So, the new rates will be 6% – 1% = 5%. Thus, rather than 6%, the investor will be paid the interest at 5%.

| Parameters | Details | ||

| Principle Amount | INR 1 lakh | ||

|

6% /annum | ||

| Maturity amount after completing 1 year | INR 1,06, 136 | ||

| One year interest rate | 7%/annum | ||

| Effective interest rate | 6%/annum | ||

| Penalty charge | 1% | ||

|

5% | ||

| Amount received at the time of premature withdrawal |

|

How Does a Bank Impose Penalty Charges on Premature FD Withdrawal?

Almost all banks impose penalty charges for withdrawing Fixed Deposits (FDs) prematurely. An investor must have complete information about the procedure and penalty charges levied by banks for withdrawing FD prematurely. Being well-informed helps in planning finances and avoiding penalty expenses.

How do banks and financial institutions penalize investors for Premature FD Withdrawal?

Let’s take an example to understand the situation better;

Lata is a working woman who lives with her husband and 12-year-old daughter. She has been working for a long time and has managed to save a decent amount of INR 10 lakh in her 15 years of working career. She invests the amount in an FD for three years at an annual interest rate of 7.5%. However, destiny had other plans. Just after a year of investing the money, Lata had an urgent need to withdraw the amount.

Now, at the time of investment, Lata received an interest rate of 7% for the one-year term and earned an ROI of 7.5% for the initial year. However, now that she is withdrawing the FD prematurely, the bank has decided to levy a penalty on the FD and recalculate the ROI as 7% – 1% = 6% per year. Hence, Lata will earn a lower payout of the FD interest. Do note that the penalty is levied only on the interest earned. However, there will be no penalty on the principal amount, which you will receive as it is.

| Amount invested |

|

|

|

7.5% p.a | |

|

7.71% p.a | |

| 1-year maturity amount |

|

|

|

7% p.a | |

|

1% | |

|

6% 7 % – 1%) | |

| The effective yearly interest rate applicable | 6.14% p.a | |

|

INR 10,61,264 |

The Process to Close an FD Prematurely

There are two methods to close an FD prematurely – online method and offline method

Offline method

For the offline withdrawal method, you simply need to visit the nearest branch of your bank. Collect the premature FD withdrawal form from the helpdesk. Complete the required paperwork and hand over the FD receipt given by the bank at the time of obtaining the FD. The bank will deduct the penalty amount from the interest earned and deposit the remaining amount in your account.

Online method

You can make your FD withdrawal online only if you have deposited the amount online. This is a rule followed by some banks. However, all banks may not follow the same. To avail of the online option to withdraw FD prematurely, you must enable your net banking facility.

Withdraw FD Online

- Login to your bank website or app

- Go to the service request page

- Look for the “Premature Closure of Fixed Deposits” tab and click on it

- Submit the required details mentioned there

- Submit a request to cancel the FD prematurely

Withdraw FD Offline

- Fill out the premature FD withdrawal form

- Fill out the necessary details like FD number, name, and bank account information

- Submit the form along with other documents like Aadhaar and PAN

- The bank will process the request and your funds will be deposited to your bank account once the FD is closed

Avoid Premature Withdrawal Penalty with Credit Card against FD

The most common reason for people to break an FD is due to a lack of funds to fulfill an urgent or important monetary need. However, an investor is expected to incur losses by withdrawing FD since they are required to pay penalties. Hence, using an alternative like getting a credit card against FD is better than withdrawing FD prematurely to manage a crisis. Credit cards against FDs are available with a credit limit of up to 80% of the principal FD amount. Get in touch with your bank helpdesk to discuss the same. The credit card will help enhance your credit score and at the same time

Fixed Deposit (FD) Premature Withdrawal Penalty Calculator

Though an investor may continue to keep the FD account active even after premature withdrawal, they, however, may not get the same interest rates.

Yes, there are differences in the penalty charges for normal customers and senior citizens and the calculator will estimate the penalty as per the different charges.

You can visit the official website of the bank to access the FD Premature Withdrawal Penalty calculator.

Author Bio

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Other Life Insurance Products

Latest Post

Showing care and love towards your loved ones can come in different forms, and purchasing a family health insurance plan is one of them. While there are several benefits of purchasing a family health insurance plan, finding one that suits your family’s needs can be confusing. Let’s walk through the top family health insurance plans to give you an insight.

Health insurance has become a household name in recent years, especially after the worldwide pandemic outbreak. People have understood the importance of having health insurance the hard way. This has significantly enhanced its popularity.

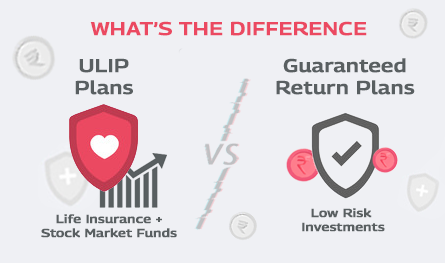

When it comes to financial planning, people often want to choose the best of both worlds: returns and security. If you have been looking for these two elements under one plan, then you would have come across ULIPs and Guaranteed Return Plans. While ULIP plans offer high returns, guaranteed return plans ensure stability and security. Which one is the most suitable for you? That's a topic worth discussing.

.png)

What about investing in a policy that promises the dual benefit of life cover and maturity benefit? That's exactly what an endowment policy does. All you need to do is save regularly to reap a lump-sum maturity benefit. Simultaneously, the policy also provides life cover to the assured. However, financial experts suggest that not every policy can be suitable for every financial goal.

When 29-year-old Shravan Kapoor planned to buy an endowment plan, he was quite sure he would be able to do that in a few minutes. However, when he opened the insurer’s website, he felt lost in the maze of endowment policies. Guaranteed returns, bonuses, maturity benefits, premium paying tenure, etc, all seemed a little too much to handle.