How to Apply for an NPS Account Online and Offline?

NPS or National Pension Scheme was launched by the government of India for offering retirement security to Indian citizens. Let’s learn about this pension plus investment plan in detail, in this post.

The National Pension Plan allows Indian citizens the option to invest in a long-term savings plan for their retirement by investing in the regulated markets. The best thing about NPS is that it can be availed by any citizen of India including NRIs and OCIs between the age of 18 to 70 years.

Interestingly, NPS has received wide acceptance by citizens across government and non-government sectors who are contributing crores of rupees to the scheme. Let’s discuss some details of the plan here.

What is National Pension Plan?

NPS or National Pension Scheme is an easy to access scheme that is affordable and tax-efficient at the same time. The pension plan is introduced for people as a retirement saving scheme to benefit them in their old age. Salaried individuals can contribute to NPS to secure their retirement, while a co-contribution comes from their employer.

The NPS account functions on the basis of defined contribution where account holders contribute to their accounts. However, no defined benefits are estimated in advance which the subscriber will receive at the time of plan exit. The corpus that is accumulated depends on the contributions made and income gained from the scheme. Depending on your contribution amount you receive the benefits. The more the contribution the better the wealth.

National Pension Plan Objectives

With NPS, Indian citizens can meet their post-retirement needs to live a comfortable life

Financial planning with NPS would support wealth creation for retirement

The NPS plan allow systemised savings planned during the working years of individuals to save for their future or old age

The NPS scheme was introduced by Indian government to address the financial concerns of senior citizens in the country

National Pension Plan Eligibility

Unlike other pension schemes, NPS allow Indian citizens including NRIs to subscribe to the scheme. As far as the entry age is concerned, 18 to 60 years is the duration during which you can join an NPS scheme

How to Apply for NPS Scheme/Account?

Online Process

You can apply for an NPS account through the online platform of eNPS. Here are the steps to register for this scheme:

Visit the eNPS portal

Select the subscriber type – Individual or Corporate Subscriber

Select residential status – such as Indian Citizen or NRI

Choose either tier I NPS account or both tier I and tier II accounts for long-term savings (tier II account is mandatory)

Submit PAN information and bank details or PoP details

Also submit the scanned copy of your PAN Card together with a copy of cancelled cheque

Now, upload scanned signature and photograph

Finally, make the payment through net banking

Once the payment is done, you will get your PRAN (permanent retirement account number).

Offline Process

For the offline process of opening an NPS account, the interested individuals need to find a PoP (Point of Presence) such as a bank. The individual has to collect a subscriber form from the nearest PoP and submit your KYC documents together.

Now, pay your initial contribution of INR 500, your PRAN number will be issued. You can pay INR 250 per month or INR 1,000 per year as a minimum contribution.

You will receive a sealed welcome package with your account number and password with which you can manage your account. You may have to pay a one-time registration fee of INR 125 for this method.

Process to Log in to the NPS Account

To login to NPS, you need a 12-digit PRAN number

To get PRAN, the subscriber has to submit the required papers at the NSDL website

Now, visit the link https://enps.kfintech.com/login/login/ to use the login page of eNPS

If you forget password, you can get it by accessing the ‘Generate/Reset Password’ tab

Now, submit the PRAN number and your DOB (date of birth). Generate OTP and fill the captcha before clicking on the ‘Submit’ button

You will receive an OTP in your registered mobile. Enter the OTP to make your password valid

Now, on the login screen, enter your password and PRAN details to Login to the page

You will be redirected to the account page and can access it with ease.

How to Apply for an NPS Account Online and Offline?

NPS stands for National Pension System.

Yes, NPS scheme India is one such pension policy that allows NRIs to join the scheme. The plan is simple to acquire as there is hardly any paperwork that an NRI needs to produce additionally. However, if there is a change in your citizenship status, your NPS account may get closed.

There are various government and private banks that are best for NPS. For instance, the 5-year term HDFC pension fund with 17.14% return is one of the best NPS schemes that you can opt for. Although, there are many other choices available as well including the NPS scheme in post offices.

Here are some NPS benefits:

Policyholders of NPS (salaried people) can claim tax deduction on the NPS investment of up to 10% of salary, which include basic plus dearness allowance

Policyholders of NPS (self-employed) can avail tax deduction of up to 20% on their gross income. For tax exemption, the NPS Maximum limit is INR 1,50,000.

NPS is a pension cum investment scheme offered by the government of India available with a long-term saving avenue to support retirement plans of individuals through planned and market-based returns.

Author Bio

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Other Life Insurance Products

Latest Post

Showing care and love towards your loved ones can come in different forms, and purchasing a family health insurance plan is one of them. While there are several benefits of purchasing a family health insurance plan, finding one that suits your family’s needs can be confusing. Let’s walk through the top family health insurance plans to give you an insight.

Health insurance has become a household name in recent years, especially after the worldwide pandemic outbreak. People have understood the importance of having health insurance the hard way. This has significantly enhanced its popularity.

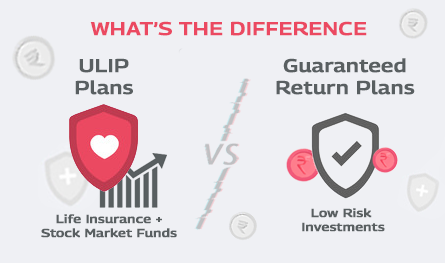

When it comes to financial planning, people often want to choose the best of both worlds: returns and security. If you have been looking for these two elements under one plan, then you would have come across ULIPs and Guaranteed Return Plans. While ULIP plans offer high returns, guaranteed return plans ensure stability and security. Which one is the most suitable for you? That's a topic worth discussing.

.png)

What about investing in a policy that promises the dual benefit of life cover and maturity benefit? That's exactly what an endowment policy does. All you need to do is save regularly to reap a lump-sum maturity benefit. Simultaneously, the policy also provides life cover to the assured. However, financial experts suggest that not every policy can be suitable for every financial goal.

When 29-year-old Shravan Kapoor planned to buy an endowment plan, he was quite sure he would be able to do that in a few minutes. However, when he opened the insurer’s website, he felt lost in the maze of endowment policies. Guaranteed returns, bonuses, maturity benefits, premium paying tenure, etc, all seemed a little too much to handle.