One of the upsides of working in the government sector is that you get a pension after retirement. This pension continues till the time you are alive. As we talk of pensions, we must know the difference between Old Pension Scheme and New Pension Scheme. Let us first start with each of their concepts.

What is Old Pension Scheme?

The pension scheme in India was introduced in 1950 and has always applied only to government employees in the country. Under the OPS Old Pension Scheme, government employees receive 50% of their last drawn basic salary. They also get Dearness Allowance. This is all provided to them once they are retired. This scheme comes with a guaranteed income. However, an employee has to work for at least 10 years to avail of this scheme.

Old Pension Scheme – Advantages

Below are some benefits of Old Pension Scheme:

It assures the pensioner of a stable and life-long income as a monthly pension

It doesn’t require the employees to contribute towards the fund, which limits the financial burden of the employee

It doesn’t attract taxes

Employees can voluntarily contribute to GPS to accumulate retirement amount

The income that can be availed after retirement is tax-free too

The pension amount goes up twice a year with the DA revision

Old Pension Scheme – Disadvantages

Here are some drawbacks of the old pension scheme:

The OPS is open only for employees who retire from government jobs

Central and State government faces massive burden under this scheme

There is no provision to lower the liability of the government

If the pension liabilities keep increasing year on year, the plan will become unsustainable

With an increased life expectancy, the government is likely to bear the pension payouts for longer durations

What is New Pension Scheme?

The New Pension Scheme, also called NPS, was introduced in 2003 by the National Democratic Alliance (NDA) government. However, it came into effect in 2004. The New Pension Scheme is available for both employees of the government as well as private sectors. Under this scheme, the employees make a contribution of 10% of their basic salary, and 14% is contributed by the employers.

Employees working in the private sector can also participate in the New Pension Scheme. When you contribute to this scheme, you get more freedom and control of your future. You will be able to benefit from the returns that are linked to the market. In addition to this, 60% of the benefit that you get on maturity is free of taxes. The remaining 40% can be invested in annuities which are 100% taxable.

New Pension Scheme – Advantages

Here are some benefits of the New Pension Scheme:

Tax benefits of up to INR 1.5 lakhs u/s 80 C is available

The plan extends to employees of government as well as non-government organizations

The investor gets more liquidity options under the NPS Tier II account since the deposits can be withdrawn as and when required

60% of the corpus withdrawn by employees at retirement is tax-free

The fund is managed by qualified professionals. It offers high returns irrespective of the tool of investment

It is easy to operate and manage NPS accounts online

New Pension Scheme – Disadvantages

Here are some drawbacks of the new pension scheme:

It requires the employees to contribute an amount from their salary

The corpus received at retirement is taxable

Account funds under NPS Tier I can’t be withdrawn unless the employee turns 60

Since the return on investments depends on the market-linked investment options, the pension received is not fixed

People who are unaware of investments tools like debts, equities, and, securities may not be comfortable

Old Pension Scheme Vs New Pension Scheme

5 Major Difference between Old Pension Scheme and New Pension Scheme

As per the Old Pension Scheme’s latest news, Chattisgarh and Rajasthan are the two states that came with the announcement of the reversion of the Old Pension Scheme instead of the New Pension Scheme. The reason is that the New Pension Scheme is uncertain, while the Old Pension Scheme comes with a higher financial cost.

While the states are trying to get the Old Pension Scheme for the employees, let us first discuss the difference between these two concepts. So, here are some of them.

1. Tax benefits:

According to the Old Pension Scheme, the pension amount is tax-free. However, as per the New Pension Scheme, 60% of the amount is free of taxes, and the rest of the 40% is taxable if it is invested in annuities.

2. Return certainty:

The Old Pension Scheme comes with the certainty of return. It is based on the monthly pension on the last salary that the employee was receiving. The New Pension Scheme comes with market-linked returns and has no guarantee.

3. Contributions:

Under the Old Pension Scheme, the monthly payments are almost equivalent to 50% of the salary that employees drew the last time before their retirement. In the New Pension Scheme, the employees contribute 10% of their salaries, and 14% is contributed by the employers.

4. Eligibility:

As the eligibility is concerned, only individuals working in the government sector can receive a pension under the Old Pension Scheme, once they retire from their service. In the New Pension Scheme, any Indian citizen between the age group of 18 years and 65 years can avail of the benefits of this scheme.

5. Flexibility:

In the Old Pension Scheme, there was not much flexibility and the monthly income was fixed. It is not the same in the case of the New Pension Scheme. You will have more freedom and can control your finances. You can have the choice of choosing your asset allocation, and it enables you in generating higher returns as well as creating a huge retirement corpus.

As we discuss the two types of pension schemes in India, they both come with their own sets of pros and cons. Therefore, before choosing the ones that suit your needs, you first need to compare both of them thoroughly and then make up your mind.

Which Category of Employees Can Opt for the Old Pension Scheme?

People who joined employment after 2014 are the ones who were covered under NPS and they were not eligible to opt for OPS once they retire. Recently, in February 2023 the DoPPW, or the Department of Pension and Pensioner’s Welfare offered a one-time option to employees working under the Central Government to opt to receive a pension under the Old Pension Scheme.

Below are some conditions which when fulfilled by the Central Government employees can choose the OPS:

If the employees are appointed for a post that was notified before the date of NPS notification (22.12.2003)

If they have joined employment on or after 01.01.2004

If the employees are covered under the NPS

In what ways is NPS better than OPS?

Both OPS and NPS have their own merits and demerits. Government employees can receive a fixed pension amount under OPS every month. Besides, they also receive increased DA two times a year.

Now, a government employee earning INR 10,000 per month as a monthly salary and DA during the time of retirement can receive a pension of INR 5000 per month (50% of last drawn salary). In addition, there are chances of this amount to increase twice a year with an increase in DA. Let’s say the employee received a 4% increase in DA. This will increase the pension per month to INR 5,200.

Alternatively, under the NPS, various factors regulate the pension amount to be received. For example, the contribution, joining age, investment type, and the income received from the investment.

Here, let’s take the example of an employee who is 35 years old and is likely to retire at 60. He invested in NPS for 25 years of his service term. As in the above case, let’s assume that the individual is drawing INR 10,000 including his basic salary and DA. The monthly contribution towards NPS will be INR 2,400 (with a 10% employee contribution and a 14% government contribution from his/her salary of INR 10,000).

In this case, when the employee retires, he/she receives INR 4,595 as a pension from the 40% corpus invested as annuities, while the remaining 60% will be offered as a lump sum amount. So, along with the pension amount, the employee will also receive a lump sum money that can be used for reinvesting or other purposes.

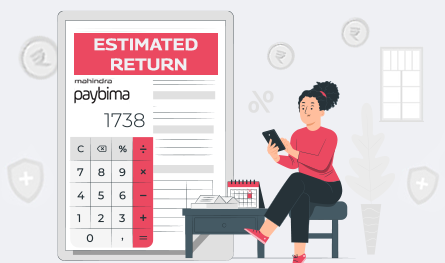

To estimate the exact amount received under NPS as pension and lump sum amount, you can use the NPS calculator.

Major Differences between Old Pension Scheme and New Pension Scheme

Government employees were eligible for OLD Pension Scheme.

The Indian states that have Old Pension Scheme are Rajasthan, Chattisgarh, Punjab, Himachal Pradesh, and Jharkhand.

The Government of India stopped pensions after 2003.

OPS means Old Pension Scheme and NPS means New Pension Scheme. NPS is a pension program based on investment, where the employee can invest in securities to earn higher returns in the long run. However, it doesn’t guarantee a fixed pension amount per month. OPS allows the employee to draw a fixed pension every month based on 50% of the last drawn salary.

NPS or the New Pension Scheme was introduced on 22.12.2003 and was implemented from 01.01.2004.

NPS contributions are invested in market-linked securities like equities, debts, etc.

NPS is better if you want to invest for your retirement life and wish to get a lump sum amount along with annuities. Here, you also get tax benefits u/s 80C and 80CCD.

Author Bio

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Other Life Insurance Products

Latest Post

Showing care and love towards your loved ones can come in different forms, and purchasing a family health insurance plan is one of them. While there are several benefits of purchasing a family health insurance plan, finding one that suits your family’s needs can be confusing. Let’s walk through the top family health insurance plans to give you an insight.

Health insurance has become a household name in recent years, especially after the worldwide pandemic outbreak. People have understood the importance of having health insurance the hard way. This has significantly enhanced its popularity.

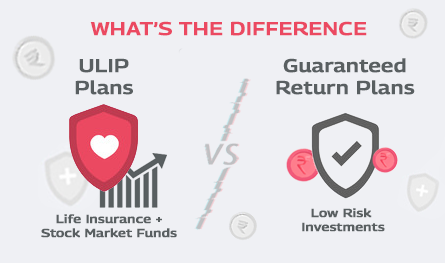

When it comes to financial planning, people often want to choose the best of both worlds: returns and security. If you have been looking for these two elements under one plan, then you would have come across ULIPs and Guaranteed Return Plans. While ULIP plans offer high returns, guaranteed return plans ensure stability and security. Which one is the most suitable for you? That's a topic worth discussing.

.png)

What about investing in a policy that promises the dual benefit of life cover and maturity benefit? That's exactly what an endowment policy does. All you need to do is save regularly to reap a lump-sum maturity benefit. Simultaneously, the policy also provides life cover to the assured. However, financial experts suggest that not every policy can be suitable for every financial goal.

When 29-year-old Shravan Kapoor planned to buy an endowment plan, he was quite sure he would be able to do that in a few minutes. However, when he opened the insurer’s website, he felt lost in the maze of endowment policies. Guaranteed returns, bonuses, maturity benefits, premium paying tenure, etc, all seemed a little too much to handle.