Post Office Gram Suraksha Yojana Calculator 2024

Insurance calculators are useful tools available online to compare and search best policies by calculating premiums of different plans. In this post, we are discussing the Post Office Gram Suraksha Yojana Calculator.

Post Office Gram Suraksha Scheme Details

The Post Office Gram Suraksha Policy is a life insurance plan with the added benefit of a plan switching facility. The insured under this plan can change it to an endowment policy after completing a period of 5 years into the scheme.

Also Read: Post office RD calculator

Understand the Post Office Gram Suraksha Yojana Calculator

Insurance calculators are tools that are freely available and can be used online to calculate premiums of various plans. The Post Office Gram Suraksha Scheme Calculator is one such tool that can be used to calculate the premium of the Gram Suraksha Yojana post office scheme. Thus, you can estimate the premium to be paid as per the benefits desired and the life coverage you seek.

The Post Office Gram Suraksha Yojana Calculator takes into account a number of factors such as income of the person, age and health condition of the person, smoking and other bad habits and so on. All these factors can be considered in the premium calculator to choose the best plan suiting your needs and goals.

Also Read: Post office scheme for boy child

How to Use the Post Office Gram Suraksha Scheme Calculator Online?

The Post Office Gram Suraksha Yojana Calculator makes it hassle-free and easy to calculate the premium of the policy. Anyone can access this calculator which is easily available on the website of insurer offering the policy.

Here are the steps that you should take after reaching the official website of the insurer.

Click on the ‘Buy Policy’ tab

Select a Quote

Now, enter the details mentioned below:

Policy seeker’s name

Contact number

Policy seeker’s email ID

Gender of the policy seeker

Date of birth

State and pin code

Sum Assured

Profession

Type of Product

Now, authenticate the details and tab on ‘get quote’

You can see the premium information on the screen

Also Read: PLI calculator

Advantages of Using Online Post Office Gram Suraksha Yojana Calculator

There are many advantages of using a gram suraksha premium calculator to compute the premium of polices as mentioned below:

| Saves Time | The best advantage of the Post Office Gram Suraksha Scheme calculator is that it saves time. You can get all the information to choose an appropriate plan matching your needs within few minutes |

| Easily Affordable | If you are looking for an reasonable plan, use a Post Office Gram Suraksha Scheme calculator to evaluate the premium amount that suits you best |

| Allow the policy seeker to choose right insurance cover | By using the Post Office Gram Suraksha policy calculator, you can easily estimate the right coverage amount of your policy. This will help in covering your family financially and to take care of your liabilities. |

| Assist in Financial Planning | The Post Office Gram Suraksha Scheme calculator will guide you regarding the premium payment that is to be done immediately after buying the plan. Knowing the premium amount to be paid will help in managing your budget for other things accordingly. |

Also Read: Post office online payment

Factors Affecting the Post Office Gram Suraksha Scheme Calculator

The Term/Tenure of Policy chosen by the policyholder determines the premium payment that is to be made

Tenure of premium payment can be chosen by the policyholder as per their comfort on a yearly, half-yearly, quarterly or monthly basis

The life coverage selected by the insured also determines the premium rates of Gram Suraksha Scheme

Age of the person buying the policy is also a factor that affects the Gram Suraksha Scheme of the post office. The more the age of the policyholder, the more the premium charged

Lifestyle habits of policyholders such as smoking are also taken into consideration while calculating the premium amount. A smoker has to pay greater premium rates as compared to a non-smoker

There are options of paying a premium. ‘You can either go for single payment, regular payment or limited payment.

Read More: Post Office Fixed Deposit Interest Rates 2024

Best Post Office Plans in India

| Plan Name | Eligibility | Sum Assured/Investment (Min) | Sum Assured/Investment (Max) | Interest Rate | ||

| National Savings Time Deposit Account | All Indian Citizens including minors | INR 1000 and multiples of100 |

|

|

||

| National Savings Monthly Income Account | All Indian Citizens including minors | INR 1000 | INR 4.5 lakh (Single Account)

INR 9 lakh (Joint Account) |

6.6 % per annum (paid monthly) | ||

| National Savings Recurring Deposit Account | All Indian Citizens including minors | 100/month (multiples of 10) | No Limit | 5.8% per annum | ||

| Kisan Vikas Patra Account | All Indian Citizens including minors | INR 1000 | No Limit | 6.9 per annum | ||

| Senior Citizen Savings Scheme Account | 60 years and above | INR 1000 | INR 15 lakh |

|

FAQs on Post Office Gram Suraksha Scheme Calculator

The minimum entry age of the plan is 19 years, while the maximum entry age is 45 years. The maximum age of maturity under the plan is 55, 58 and 60 years.

The Post Office Gram Suraksha Scheme is a policy that is available with impressive returns with low risk. Under this scheme, the investor is required to deposit INR 1500 monthly to receive a corpus of INR 31 -INR 35 lakhs at maturity.

The Gram Suraksha Yojana is a social security scheme where the insured is required to invest INR 1500 per month to earn INR 35 lakh at maturity. The entry age of the plan is 19 years. You can buy this plan online or visit the nearest branch of the post office to avail this plan.

To calculate the postal life insurance premium, you can use a postal life insurance premium calculator.

Below are 6 Best Postal Life Insurance (PLI) Plans 2024:

Whole Life Assurance (Suraksha)

Endowment Assurance (Santosh)

Convertible Whole Life Assurance (Suvidha)

Anticipated Endowment Assurance (Sumangal)

Joint-Life Insurance (Yugal Suraksha)

Children Policy (Bal Jeevan Bima)

Author Bio

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Other Life Insurance Products

Latest Post

Showing care and love towards your loved ones can come in different forms, and purchasing a family health insurance plan is one of them. While there are several benefits of purchasing a family health insurance plan, finding one that suits your family’s needs can be confusing. Let’s walk through the top family health insurance plans to give you an insight.

Health insurance has become a household name in recent years, especially after the worldwide pandemic outbreak. People have understood the importance of having health insurance the hard way. This has significantly enhanced its popularity.

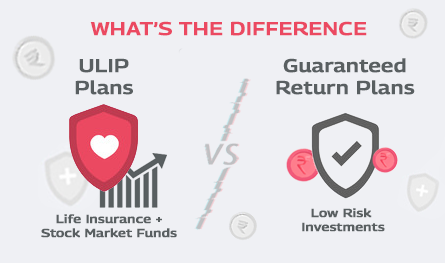

When it comes to financial planning, people often want to choose the best of both worlds: returns and security. If you have been looking for these two elements under one plan, then you would have come across ULIPs and Guaranteed Return Plans. While ULIP plans offer high returns, guaranteed return plans ensure stability and security. Which one is the most suitable for you? That's a topic worth discussing.

.png)

What about investing in a policy that promises the dual benefit of life cover and maturity benefit? That's exactly what an endowment policy does. All you need to do is save regularly to reap a lump-sum maturity benefit. Simultaneously, the policy also provides life cover to the assured. However, financial experts suggest that not every policy can be suitable for every financial goal.

When 29-year-old Shravan Kapoor planned to buy an endowment plan, he was quite sure he would be able to do that in a few minutes. However, when he opened the insurer’s website, he felt lost in the maze of endowment policies. Guaranteed returns, bonuses, maturity benefits, premium paying tenure, etc, all seemed a little too much to handle.