LIC’s Jeevan Tarang (Plan-178) – Key Features, Benefits, Eligibility and Exclusions

LIC Jeevan Tarang (Plan-178) is a Whole Life Insurance Policy that offers bonus facilities. Let’s discuss the benefits and features of this plan offered by India’s most reliable insurer, in this post.

- Key Features of LIC Jeevan Tarang Policy

- Eligibility Criteria of Jeevan Tarang Plan

- Jeevan Tarang Plan 178 Benefits

- Policy Details of Jeevan Tarang Policy

- Documentation Needed for Jeevan Tarang Policy

- Exclusions of Jeevan Tarang Policy

- LIC Jeevan Tarang Plan 178 with Example

- How does the Jeevan Tarang Plan Function?

- Jeevan Tarang plan 178 Bonus Calculator

- LIC Jeevan Tarang Plan – Rates of Loyalty Additions

- Income Tax benefits of Jeevan Tarang Plan No. 178

- The Process to Buy Plan Online

LIC Jeevan Tarang Policy Features

Below are some key features of the Jeevan Tarang (Plan-178):

INR 1 lakh is the minimum sum assured under the plan

For maximum sum assured, there is no limit

10, 15, or 20 years is the Premium Paying Term of the plan

The insured can pay the premium on an annual, semi-annual, quarterly, and monthly basis

The nominee receives death benefit as Sum Assured together with loyalty additions and + accrued Bonus

The policy offers five and half percent of the Sum Assured every year as Survival Benefit after the period of accumulation

On maturity or in case of earlier death of the insured, Simple Reversionary Bonus is paid

The plan offers three basic riders – Term assurance Rider, Accidental Death Benefit rider and Critical Illness rider

Eligibility Criteria of Jeevan Tarang Plan 178

| Eligibility criteria | Details |

| Min. age of entry | 0 |

| Max. age of entry | 60 years |

| Max. age of maturity | 100 years |

| Min. age when accumulation period ends | 18 years |

| Age during completion of premium payment term | 70 years |

| Duration of premium payment | Term of policy minus 3 years |

| Min. sum assured duration | INR 1 lakh |

| Max. sum assured duration | No upper limit |

Jeevan Tarang Plan 178 Maturity Benefits

Maturity benefits – The plan matures once the policyholder turns 100 years. Hence, in case the insured outlives the plan till 100 years of age, he/she receives the complete sum assured along with the loyalty bonus.

Death benefit – In the event of death of the policyholder during the policy tenure, the nominee receives a sum assured and vested bonus before policy getting terminated.

Survival benefit – In case the life assured outlives the policy term, a bonus of vested reversionary is paid in lump sum.

Income tax benefit – Tax deduction is available for all premiums paid under Section 10 (10D) and Section 80 C.

Rider benefit – Available riders under the plan are accidental benefit rider, term rider, critical illness rider, and premium waiver for critical illness.

LIC Jeevan Tarang Plan 178 Details

Grace period – A grace period of 30 days is allowed for premium payment that is paid annually, semi-annually, and quarterly, while 15 days of grace period is offered on monthly premium payment.

Loan – The Jeevan Tarang Plan from LIC is available with a loan facility. So, the investor can apply for a loan under this plan. The current rate of interest of the policy is 9 %.

Cooling off period – If the policyholder is not happy with the terms of the plan, he/she can surrender the policy within 15 days of joining the plan.

Period of revival – A lapsed policy can be revived during the lifetime of the policyholder. However, it should be done before the expiry of the accumulation period.

Rebate – 2% tabular premium rebate under yearly mode is offered, while it is 1% in case of half-yearly mode. Rebates are also available on High SA on an annual premium.

Documents Required for Jeevan Tarang Policy

Below are the documents required to apply for LIC Jeevan Tarang Plan 178:

Application form

Photographs (passport size)

Proof of Address

Proof of Age

Medical reports

Exclusions

The one exclusion of the Jeevan Tarang 178 Policy is that the plan becomes invalid in case the insured commits suicide during 1 year from the date of policy initiation. In that case, the insurer will not pay any returns to the nominee of the policy.

LIC Jeevan Tarang (Plan 178) Example:

To better comprehend the advantages of the plan, let’s use the example of a person who purchases a Jeevan Tarang policy using the information listed below.

| Age |

|

Sum Assured | 10,00,000 | |||

|

|

Premium Payment |

|

At the conclusion of the 20-year period during which premiums are paid, an Accrued Bonus* amount of Rs. 9,80,000/- will be paid.

Following that, annual survival rates at the rate of 5% of the assured amount (Rs. 55,000/-) will become due until death or 100 years of age, whichever comes first.

The sum assured of $10,000 plus any applicable loyalty additions will also become payable upon death or upon reaching the age of 100.

How does Jeevan Tarang Work?

The Jeevan Tarang Plan is available with a policy term of 10, 15, or 20 years. The insured can make payment of the premium annually or regularly. Once the duration of the premium payment is over, the insured can get the accrued bonus in a lump sum amount.

As soon as the accumulation period completes, the annual life-long benefit of survival begins, which is equivalent to 5.5% of your policy sum insured. Further, the policy also offers death coverage to the insured for up to 100 years or all through the policyholder’s life span. In the event of the death of the policyholder, the nominee receives the sum assured plus loyalty additions.

Jeevan Tarang plan 178 Bonus Calculator

Life Insurance Corporation of India (LIC) shares profit with their policyholders by benefiting them with a simple reversionary bonus declared every year after the implementation of the valuation. Below are the bonus rates declared for Jeevan Tarang Policy:

| PPT – Premium Paying Term |

|

15 years | 20 years | ||

|

|

INR 48/1000 sum assured | INR 49/1000 sum assured |

As you know, the bonus rates are paid for INR 1000 of your policy Sum Assured. Every year, the insurer adds the declared bonus to your Jeevan Tarang policy after declaring it.

For instance, if your policy sum assured is INR 10,00,000, while the bonus declared by LIC is INR 49. You will get a bonus amount of 49,000.

10,00,000 * 49/1000 = 49,000

LIC Jeevan Tarang Plan – Rates of Loyalty Additions

The loyalty additions are paid by the insurer when the policyholder exits the plan due to plan maturity or due to the death of the policyholder. It is a one-time expense and the rates are valid for the exit year only.

Income Tax benefits of Jeevan Tarang

This Jeevan Tarang plan follows EEE or Exempt-Exempt-Exempt taxation model:

The premium paid under the plan is entitled to tax exemptions

The bonus received under the plan after the end of the term of premium payment is also tax exempted

The benefit of survival offered by the insurer each year after your Jeevan Tarang policy premium paying term is ended is also excused from tax paying

The death benefit received after the demise of the policyholder also doesn’t come under the purview of income tax

The Process to Buy Plan Online

The latest developments in the digital platforms offered by LIC now make it easy for consumers to enjoy various online services. The insurer has ensured a user-friendly portal for the consumers to make their experience smooth in accessing the website. The policyholders can now easily track the status of their policy, buy a plan online, and make payments through digital mode.

Here are the basic steps to follow for purchasing a policy online:

Go to the official website of the insurer and choose a plan

Click on the option of ‘Buy’ the plan

Your details like your name, DOB or date of birth, age, contact number, address, and habits like smoking/drinking should be mentioned in the next step

Make the online payment using a payment gateway available to complete your buying process

Once the payment is successfully done, you will receive the receipt of the payment on your mobile number and email ID

LIC's Jeevan Tarang Plan

The Jeevan Tarang Whole Life Plan matures when the Life Insured turns 100 years old.

One key feature of the plan is that there is no limit on the maximum sum assured.

Jeevan Tarang policy can be surrendered after completing three years of the policy.

Death Benefit is payable as Sum Assured + accrued Bonus + Loyalty Additions if any.

1 lakh is the minimum sum to be invested under this plan initially. Later, you can deposit amounts in multiples of INR 5000.

The LIC Jeevan Tarang Plan offers a grace period of 30 days for paying premiums, which can be done on an annual, semi-annual, and quarterly basis. For paying monthly premiums, the grace period is fifteen days.

Yes, the policyholder under LIC Jeevan Tarang can avail of a loan under the plan. However, you may note that the interest rate under the plan may be revised by the insurer from time to time.

Yes, as per the cooling-off period, the policyholder can return the policy to LIC if the individual is not satisfied with the terms of the plan within the first fifteen days of buying the policy. However, the person has to give appropriate reasons for withdrawing from the policy.

No, the loyalty additions under this plan are not pledged but are subject to the profit incurred.

Author Bio

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Other Life Insurance Products

Latest Post

Showing care and love towards your loved ones can come in different forms, and purchasing a family health insurance plan is one of them. While there are several benefits of purchasing a family health insurance plan, finding one that suits your family’s needs can be confusing. Let’s walk through the top family health insurance plans to give you an insight.

Health insurance has become a household name in recent years, especially after the worldwide pandemic outbreak. People have understood the importance of having health insurance the hard way. This has significantly enhanced its popularity.

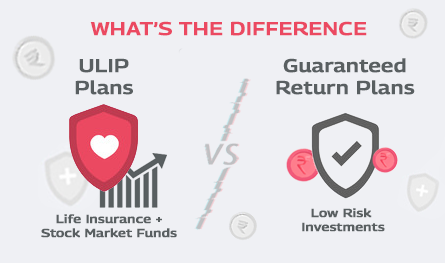

When it comes to financial planning, people often want to choose the best of both worlds: returns and security. If you have been looking for these two elements under one plan, then you would have come across ULIPs and Guaranteed Return Plans. While ULIP plans offer high returns, guaranteed return plans ensure stability and security. Which one is the most suitable for you? That's a topic worth discussing.

.png)

What about investing in a policy that promises the dual benefit of life cover and maturity benefit? That's exactly what an endowment policy does. All you need to do is save regularly to reap a lump-sum maturity benefit. Simultaneously, the policy also provides life cover to the assured. However, financial experts suggest that not every policy can be suitable for every financial goal.

When 29-year-old Shravan Kapoor planned to buy an endowment plan, he was quite sure he would be able to do that in a few minutes. However, when he opened the insurer’s website, he felt lost in the maze of endowment policies. Guaranteed returns, bonuses, maturity benefits, premium paying tenure, etc, all seemed a little too much to handle.