Why you should buy an SBI life insurance policy?

Buying an SBI life insurance policy is the wisest thing that you can do. Here are some of the reasons explaining the same.

- The nominee or family members of the policyholder will receive the death benefit in case the latter passes away during the policy term

- If the policyholder survives through the policy term, he/she will receive maturity benefits

- As you take an SBI life insurance 50,000 per year plan for 5 years, you will receive a high return on shorter investment

- You can have proper planning for your future.

6 Best SBI life insurance plans for 5 years?

1.SBI Life Retire Smart

2.SBI Life Shubh Nivesh

3.SBI Life Smart Platina Assure

4.SBI Life Smart Wealth Builder

5.SBI Smart Wealth Assure

6.SBI Life Grameen Bima

SBI life insurance plans for 5 years – Detailed Overview

If you are interested in opting for SBI life insurance 50,000 per year plan for 5 years, then here are some of the plans that you can consider.

| Names of SBI Life Plans |

Names of SBI Life Plans |

PT/PPT/SP |

|

|

|

|

Unit Linked Pension |

5 Years |

30 Years |

80 Years |

| Shubh Nivesh |

|

5 Years |

18 Years |

|

| Smart Platina Assure |

Endowment |

6 Years |

3 Years |

75 Years |

| Wealth Builder |

|

5 Years |

2 Years |

70 Years |

| Wealth Assure |

|

10 Years |

8 Years |

70 Years |

| Grameen Bima |

Micro Finance |

5 Years |

|

NA |

Let us know a bit more about these plans.

1. SBI Life Retire Smart

Planning for retirement is one of the most important things that we should do. You must make plans ahead so that you do not have to be dependent on anyone post-retirement. This is where the SBI Life Retire Smart plan works perfectly.

Highlights of the SBI Life Retire Smart:

- Guaranteed additions of annualized premium help in boosting the fund value

- The vesting age can be postponed

- You can choose regular, limited, or single premium payment options at your convenience

- For regular, the minimum annualized premium is INR 24,000; for limited, it is INR 40,000; and for single premium payment, it is INR 1 Lakh.

Features of the SBI Life Retire Smart:

| Features |

Details |

| Plan Term |

10/15/30 years |

|

|

As per premium |

|

|

Death benefit, surrender benefit maturity benefit, and deferred vesting benefit |

| Nomination |

Available |

|

|

30 days (Online policy purchase) and 15 days (for others) from the policy buying date |

| Entry age |

Min. 30 years, Max. 70 years |

| Maturity age |

| Min. 40 years, Max. 80 years |

|

2. SBI Life Shubh Nivesh

It is a non-linked, non-participating, and insurance-saving product and lets you choose a Whole Life Coverage. The benefits can be broken into a regular income stream.

Highlights of the SBI Life Shubh Nivesh:

- The coverage can be extended to the whole life

- The payment mode can be regular or single pay

- The coverage can be boosted by choosing riders against an additional premium

- The minimum single payment premium is INR 43,000, while there is no cap on the upper limit.

Features of the SBI Life Shubh Nivesh:

| Features |

Details |

| Plan Term |

5/7/15/30 years |

| Premium payment frequency |

|

Monthly, quarterly, yearly, and half-yearly |

|

|

Available (limited to 90% of special surrender value) |

| Nomination |

Available |

|

|

15 days from the policy buying date |

| Entry age |

| Min. 18 years, Max. 50 years |

|

| Maturity age |

| Min. 65 years, Max. 100 years |

|

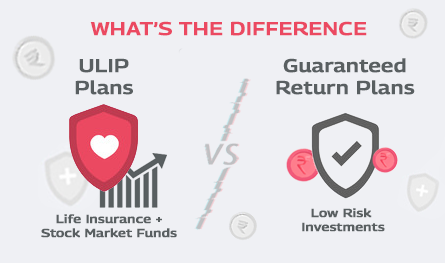

3. SBI Life Smart Platina Assure

It is an endowment plan which is non-linked and non-participating. By paying for a limited time, you can get guaranteed returns under this policy.

Highlights of the SBI Life Smart Platina Assure:

- Along with guaranteed income, the plan offers life cover

- Depending on the policy payment term you choose, you can get assured guarantee additions of 5.25% to 5.75% at the end of each year

- You can choose 6 and 7 years for policy payment for 12 and 15 years term

- You can pay the premium either monthly or annually

- The minimum premium that you can pay yearly is INR 50,000.

Features of the SBI Life Smart Platina Assure:

| Features |

Details |

| Limited premium payment option |

|

|

| Premium payment frequency |

|

Monthly, half-yearly, and Yearly premium payment |

|

|

Available |

| Plan Benefits |

Maturity, survival, and death benefits |

|

|

Min. 7 years, Max. 60 years |

|

|

Min. 65 years, Max. 99 years |

4. SBI Life Smart Wealth Builder

It is an individual-linked and non-participating plan that helps the policyholders to plan their retirement and create a wealth corpus accordingly.

Highlights of the SBI Life Smart Wealth Builder:

- Additions are guaranteed

- The plan comes with a lock-in period of 5 years

- The premium payment is available in all the options such as regular, limited, and single payment

- The minimum payment for a single premium is INR 65,000.

Features of the SBI Life Smart Wealth Builder:

| Features |

Details |

|

|

| Regular/limited/single plan |

|

|

|

|

Single/Annual |

|

|

Available |

| Coverage benefit |

Maturity benefit, death benefit |

|

|

Min. 2 years, Max. 55 years |

|

|

Min. 18 years, Max. 70 years |

5. SBI Smart Wealth Assure

This is a unit-linked plan and targets individuals who want to invest in higher yields through market-linked tools.

Highlights of the SBI Smart Wealth Assure:

- By paying a single premium, you can avail of life coverage for the policy term

- You can check out all the seven market-linked funds and choose any one to earn higher returns

- The lock-in period is for 5 years

- You can add riders to boost your coverage

- The minimum premium you have to pay is INR 50,000, while there is no cap on the upper limit.

Features of the SBI Smart Wealth Assure:

| Features |

Details |

|

|

|

|

|

Single |

|

|

Available |

| Basic sum assured |

|

|

|

| Min. 8 years, Max. 60 years |

|

|

|

|

6. SBI Life Grameen Bima

It is a microfinance life insurance policy that is non-linked and non-participating.

Highlights of the SBI Life Grameen Bima:

- You can pay the premium only once

- Depending upon your finances and affordability, you can choose the premium to be paid

- There is no pre-medical evaluation carried out; instead, enrollment is done based on a questionnaire

- The minimum single premium is INR 300 and the maximum is INR 50,000. The amount changes depending on the age bands.

Features of the SBI Life Grameen Bima:

| Features |

Details |

|

|

|

| Premium payment frequency |

|

Single |

|

|

Death benefit and maturity benefit |

| Surrender value |

| Available from the second year of the policy |

|

|

|

| 15 days from the policy buying date |

|

|

|

| Min. 18 years, Max. 50 years |

|

.png)