Best General Insurance Company in India 2024

With the rising inflation in the country, having an active insurance policy with good coverage has become imperative for most of us. It protects us from the risk of incurring losses in event of the untimely death of a family member, a medical emergency, damage or theft of a vehicle, etc. There are several advantages of having an insurance policy for managing the many risks in our lives.

- Overview of a General Insurance Company

- What is a General Insurance Company?

- Importance of General Insurance

- Types of General Insurance Policies

- Overview of General Insurance Policies Types

- How to Choose the Best General Insurance Company?

- 10 Top-Listed General Insurance Companies, India

- Bajaj Allianz General Insurance Comapny

- Bharti AXA General Insurance Company

- Cholamandalam MS General Insurance Company

- Future Generali India Insurance Company

- HDFC ERGO General Insurance Company

- ICICI Lombard General Insurance Company

- IFFCO TOKIO General Insurance Company

- Kotak Mahindra General Insurance Company

- Liberty General Insurance Company

- Magma HDI General Insurance Company

- Navi General Insurance

- Edelweiss General Insurance

- Universal Sompo General Insurance Co. Ltd

- Go Digit General Insurance

- Tata AIG General Insurance Company Limited

- Top 4 Public Sector General Insurance Companies

- Top 10 Private Sector General Insurance Companies

Overview of a General Insurance Company

A General insurance Company is the one that offers various insurance policies under different categories other than life insurance. Health, Motor, Home, Travel, and Marine insurance are different types of general insurance policies offered by a general insurance company. So, overall general insurances cover all insurances other than life insurance.

What is a General Insurance and How do the General Insurance companies’ function?

Unlike in life insurance, the tenure of general insurance does not last an entire life. General insurance policies have definite tenure or purpose for which the plan is purchased. Most of the general insurance plans are available with annual renewal terms, while there may be some that are available for longer duration.

General insurance refers to a range of non-life insurance products that can help us protect our assets against monetary losses or unexpected expenses. A wide range of insurance policies that can protect our properties such as houses, shops, and vehicles, as well as health insurance policies can all be categorized as general insurance. General insurance provides coverage only for a particular period such as annual plans.

To understand how the general insurance companies work, let us take an example. For instance, suppose 10 individuals are paying for their vehicle insurance to an insurance company at INR 1000 per person per year. So, the insurer earns INR 10,000 per year as a total amount for covering 10 bikes. Now, generally it doesn’t always happen that all the policyholders make claims for damages. Hence, mostly 1 or 2 individuals make a claim in a particular year for a particular damage. Thus, the insurer pays the claims of such damages, which is generally much less than the INR 10,000 earned by them in a year. This way, the general insurance policies function to support people in need.

Importance of General Insurance

The key benefit of having any kind of insurance policy is the coverage against losses or risks. Several valuable things matter to us, and we may wish to safeguard these against any loss. General insurance policies can help you do that by providing coverage in case of theft, accident, medical emergencies, hospitalization, damage to property, and other eventualities.

What are the 9 top General Insurance Policies in India?

Depending on the asset that the general insurance policy is providing coverage for, there can be several different types of policies. Here are some of the common general insurance types.

Motor Insurance

Health Insurance

Travel Insurance

Home Insurance

Marine Insurance

Agricultural/Rural Insurance

Mobile Insurance

Bicycle Insurance

Commercial Insurance

Also Read: Top 10 Largest Insurance Brokers in India

9 General Insurance Policies Types – Overview of Each One

Below are the different types of insurance plans available under the general insurance category:

1. Motor Insurance

These insurance policies offer coverage against vehicle damages caused by accidents and other emergencies like natural calamity, theft, riots etc. Motor insurance can be of two types – the third-party motor insurance and the comprehensive motor insurance.

The third-party plan is an obligatory policy that covers only the third parties for property damages and bodily injuries and death. On the other hand, the comprehensive plan covers both third-party damages and your own vehicle damages.

2. Health Insurance

A health insurance policy allows coverage against healthcare costs of the policyholder and his/her family members depending on the plan caused by hospitalisation due to an illness or injury. Further, the insured can avail added riders to enhance the insurance coverage.

3. Travel Insurance

When you plan an international trip for business purposes or for vacation it is better to cover yourself against any bad experiences such as loss of documents or baggage, delays in flights, medical issues etc. Any such incident may cease the fun aspect of your trip and hence a travel insurance plan is required to compensate for the situation.

4. Home Insurance

A home insurance is needed to cover your home against natural calamities, man-made disasters and so on. A home insurance provides protection to your house from all kinds of damages, like fire, burglary, flood, theft, earthquakes etc.

5. Marine Insurance

In case of businesses which involve import/export of products and articles across international as well as Indian borders, it requires insurance to ensure the safety of the goods during transit.

Also Read: Best Health Insurance Company in India as Per CSR

6. Rural Insurance

These insurances offer solutions to meet various requirements of agriculture and rural businesses in the rural areas. As per the guidelines of IRDA, insurance companies must provide insurance to the rural and social sectors as per the specified annual targets set by IRDA.

7. Mobile Insurance

A mobile insurance policy allows coverage against damages to your mobile screen. It can be bought for new as well as old mobiles at reasonable costs

8. Bicycle Insurance

Bicycle insurance is used by people to insure their expensive bicycles against any damages or accidents, theft, etc.

9. Commercial Insurance

Commercial insurance allows coverage against different industries that you may be involved in. Aviation, Construction, Automotive, are some of the commercial insurance sectors along with pharmaceuticals, telecom, power etc. Engineering insurance, energy insurance, property insurance etc. are some common types of commercial insurances.

How to Choose the Best General Insurance Company in India?

You can consider some key parameters when selecting a General Insurance provider which can minimize the chances of any risk of the company not fulfilling their promises. Here are some of the parameters to consider.

Claim Settlement Ratio

Claim Processing time

Sound financial standing of the company

Market reputation of the company

Customer Service Responsiveness

Net Promoter Score or NPS

Tax benefits with General Insurance Policies

General Insurance policies that offer medical or health insurance can also help the policyholders in saving taxes. Medical insurance policy premiums are eligible for deduction from your total income under section 80D of the Income Tax Act. You can claim up to INR 15,000 under the premium for your health insurance plan and you can also extend it another 20,000 for the premium paid for health insurance plans of senior citizens.

Top 15 General Insurance Companies in India

| Insurance Company | Headquarters | Fire Insurance – ICR (2019-20) | Marine Insurance – ICR (2019-20) | Motor Insurance – ICR (2019-20) | Health Insurance – ICR (2019-20) | Others – ICR (2019-20) | Total – ICR (2019-20) | |||

| Bajaj Allianz General Insurance Company | Pune – Maharashtra | 68.01 | 67.15 |

|

81.96 | 73.81 | 70.74 | |||

| Bharti AXA General Insurance Company | Mumbai – Maharashtra | 75.21 | 116.1 | 81.91 | 77.5 |

|

78.33 | |||

| Cholamandalam MS General Insurance Company | Chennai – Tamil Nadu | 42.28 |

|

82.95 | 40.67 | 47.2 | 74.99 | |||

| Future Generali India Insurance Company | Mumbai – Maharashtra | 53.23 | 58.63 | 57.67 | 62.52 | 65.42 | 59.66 |

|||

| HDFC ERGO General Insurance Company | Mumbai – Maharashtra | 69.99 | 81.73 | 79.21 | 69.01 | 85.37 |

|

|||

| ICICI Lombard General Insurance Company | Mumbai – Maharashtra | 64.02 | 65.26 | 76.53 | 69.9 |

|

72.86 |

|||

| IFFCO TOKIO General Insurance Company | Gurugram – Haryana | 45.67 | 63.93 | 87.77 | 95.66 | 87.15 | 88.61 | |||

| Kotak Mahindra General Insurance Company |

|

80.99 | – | 75.66 | 49.22 | 43.82 |

|

|||

| Liberty General Insurance Company | Mumbai – Maharashtra | 2.05 | 59.37 | 70.95 | 87.78 | 36.36 | 72.42 | |||

| Magma HDI General Insurance Company | Kolkata – West Bengal | 70.86 | 174.31 | 85.13 | 72.87 | 57.94 | 84.35 | |||

| Navi General Insurance | Mumbai – Maharashtra | -13.39 | _ |

|

34.69 | 81.18 | 66.52 | |||

| Edelweiss General Insurance | Mumbai – Maharashtra | 120.61 | 81.99 | 116.31 | 113.05 | 98.66 | 114.7 | |||

| Universal Sompo General Insurance Co. Ltd | Mumbai – Maharashtra | 42.33 |

|

89.54 | 76.68 | 39.56 | 73.41 | |||

| Go Digit General Insurance | Bengaluru – Karnataka | 78.11 | 50.34 | 74.82 | 51.83 | 91.77 | 75 | |||

| Tata AIG General Insurance Company Limited | Mumbai – Maharashtra | 61.52 | 73.92 | 80.29 |

|

85.8 | 77.44 |

1. Bajaj Allianz General Insurance Comapny

This is the first name that needs to be taken in this particular context. The company is reputed to keep its customers at the center of all the work that it does as a business organization. It is also active in more than 200 cities across the country. It has a network of 4000 garages as part of its cashless services where you can get cashless claim settlement.

2. Bharti AXA General Insurance Company

When you think of the top general insurance companies list this is one name that comes to mind immediately. The company started to work in 2008 and ever since it has established a firm grip on the general insurance industry as a whole. It is known for selling car insurance plans with a diverse array of add-on covers. It has at least 4500 cashless garages in its network across the country where you get quick cashless claim settlement.

3. Cholamandalam MS General Insurance Company

This is one of the best among all general insurance companies in India for sure. It has 104 branches across the country along with over 8800 advisory networks. It caters to 90 lakh people. When it comes to claim settlement it has an impressive record with two lakh claims settled each year!

4. Future Generali India Insurance Company

It was in 2007 that the organization started its operations. Ever since it has confirmed its position as one of the top general insurance company names in India. It has at least 130 offices across the country and there are over 2500 garages in its cashless network. This has helped it settle at least 16.7 lakh claims to date.

5. HDFC ERGO General Insurance Company

When you compile a top list of general insurance companies this is one name that you have to put in there for sure. In any case, HDFC ERGO is a name to be reckoned with in the entire general insurance industry as such. It has won several prestigious awards such as ICRA (Investment Information and Credit Rating Agency) and IAAA ratings. It is well known for the high-quality support that it offers to its customers.

Buying a policy from them is absolutely hassle-free and the same goes for renewal as well. Also, it has over 6800 garages in its cashless network.

Also Read: Top Investment Options for Investing ₹1 Lakh for 6 Months

6. ICICI Lombard General Insurance Company

No best list of general insurance companies in India is complete without this particular insurer. In 2019 fiscal it settled 93.14% of the claims that came its way. In most of these cases, the claims were settled within 30 days of filing them. In its network, you have over 7800 cashless garages where you can avail of cashless claim settlement services. This is the highest among all car insurers in India.

7. IFFCO TOKIO General Insurance Company

It is hard to imagine a list of the best general insurance companies in India without this name. The company boasts of a huge portfolio of insurance policies and it also offers a high amount of add-on coverage options. It has at least 4300 cashless garages all around the country. Here you can get a cashless claim settlement in a short time.

8. Kotak Mahindra General Insurance Company

The company was incorporated back in 2014 and ever since it has been on the top general insurance company name list in India. It has established itself as a name to be reckoned with in the general insurance industry. It offers all sorts of car insurance policies to its customers along with facilities such as premium protection.

9. Liberty General Insurance Company

This is also there on the top vehicle insurance companies list. It is firmly entrenched across 20 cities in India and also boasts of a huge network of 3500 garages as part of its cashless network. As such, it can be said that it does have a considerable presence in the general insurance sector of the country. You can buy its policies online as well as from the branches.

10. Magma HDI General Insurance Company

If you think of all the general insurance companies in India this one ranks right up there. It was formed in 2009 when Magma Fincorp Limited collaborated with HDI-Gerling Industrie Versicherung AG. It now has five zonal offices as well as 135 branches across the country. Apart from the urban locations, the company also enjoys a considerable presence in rural areas.

Also Read: Best Car Insurance Companies in India with CSR

11. Navi General Insurance

Navi General Insurance, a subsidiary of Navi Technologies (previously known as BACQ), started operations in the year 2017. With a wide range of health, motor, fire, asset, and other insurance products, Navi General Insurance is not just meeting the needs of its customers but has also gained their confidence and trust. The company has been transparent in its approach to customers and aims to make insurance buying and availing an easy task. They are also known for their quick claim approval services.

12. Edelweiss General Insurance

Edelweiss General Insurance Company was established in March 2016 and is a part of Edelweiss Group, which is a multinational company based in Mumbai, Maharashtra. The company offers insurance coverage across multiple fields such as health, motor, fire, marine, and more. Renowned for its hassle-free buying process as well as its simple and smooth claim and transaction process, Edelweiss is a customer-friendly company that keeps its customers well informed and ahead.

13. Universal Sompo General Insurance Co. Ltd

Universal Sompo General Insurance emerged as a collaboration in the year 2007. The joint venture was formed between various financial institutions and entities in India like Bank of India, Karnataka Bank Ltd, Overseas Bank of India, and Dabur Investment Corporation together with a Japanese insurance conglomerate Sompo Japan Insurance Inc.

Headquartered in Mumbai, the insurer presents a wide range of products to cater to its customer’s needs across sections. The company is offering a hassle-free customer experience with the help of advanced technologies.

14. Go Digit General Insurance

Go Digit is an insurance provider in India that functions online and offers a range of insurance products in fields like health, motor, travel, home, mobile, and so on. With its online presence spread across the country, the insurer aims to make the insurance buying and renewing process simpler and smoother for everyone. Based in Pune and Bengaluru, they use a multi-channel distribution strategy to resolve claims and service queries.

15. Tata AIG General Insurance Company Limited

Established in 2001, Tata AIG is another insurance company formed as a collaboration between the Tata Group and American International Group (AIG). With its headquarters in Mumbai, the insurer has a wide market presence and a range of products in legal, marine, PA, travel, and other fields. The company is spread across its 200+ offices in India and has a workforce of over 6,000 employees.

General Insurance Companies- Public Sector

| Top Public Sector General Insurance Companies | Founding Year | Headquarter |

| National Insurance Company Limited | 5 December 1906 | Kolkata |

| New India Assurance Company Limited | 23 July 1919 | Mumbai |

| Oriental Insurance Company Limited | 12 September 1947 | New Delhi |

| United India Insurance Company Limited | 18 February 1938 | Chennai |

General Insurance Companies- Private Sector

| Top Private Sector General Insurance Companies | Founding Year | Headquarter |

| Bajaj Allianz General Insurance Co.Ltd. | 2000 | Pune |

| Bharti AXA General Insurance Co.Ltd. | 2007 | Bengaluru |

| Cholamandalam MS General Insurance Co.Ltd | 2001 | Chennai |

| Future Generali India Insurance Co. Ltd. | 2000 | Mumbai |

| HDFC ERGO General Insurance Co. Ltd. | 2002 | Mumbai |

| ICICI Lombard General Insurance Co. Ltd. | 2001 | Mumbai |

| IFFCO TOKIO General Insurance Co. Ltd. | 2000 | Gurugram |

| Kotak Mahindra General Insurance Co. Ltd. | 2015 | Mumbai |

| Liberty General Insurance Co. Ltd. | 2013 | Mumbai |

| Magma HDI General Insurance Co. Ltd. | 2009 | Mumbai |

Factors to Consider While Investing in General Insurance Policies

Here are some factors that need to be considered while investing in general insurance:

Low Premiums – The premium price of a plan indicates if the policy is costly or inexpensive. General insurance policies like vehicle insurance, health insurance, home insurance, etc., are used to safeguard assets against financial risks. However, you have to pay a premium for the same to ensure the safety and security of your assets against damages. It is important to consider that the premium charged for the plan is inexpensive and within your budget.

Hassle-free purchase process – Most people stay away from insurance coverage because they think insurance buying is a hassled process. Online and offline are the two ways of buying insurance. You may consider a policy that offers a smooth and hassle-free online buying procedure without the involvement of agents. Moreover, it may also fetch you online purchase discounts. Besides, you may calculate the premium and the benefits received with the help of an online calculator.

Protection against damage – With insurance coverage, you can ensure protection against monetary losses and damages caused to your vehicle, or any other asset. Also, they safeguard you against third-party damages caused by your vehicle.

Total protection – With comprehensive coverage, you may ensure protection against your own damages. So, in the event of a fire, theft, natural disaster, etc, you may rely on your comprehensive insurance for protection against such damages and losses. Hence, look for policies with comprehensive protection for complete safeguard.

Insurance company reputation – Since a large number of insurance companies are offering numerous products, it is important to consider the reliability of the insurer in terms of settling claims. Knowing about the insurer is important to ensure that you are trusting a company that can indeed help you in need.

CSR or Claim Settlement Ratio – Some insurers may lure you with lucrative deals and offers at the time of buying an insurance policy. However, the real issue comes at the time of claim settlement. Hence, checking the CSR of the insurer is important. So, while opting for the top private general insurance companies in India, always rely on a company with high CSR.

Customer reviews – Nowadays, customer reviews have become a great way to know about a company. You may come to know the loopholes and success stories of an insurance company by spending some time and reading reviews.

Why Is It Necessary to Consider the Best Insurance Companies for General Insurance?

An insurance policy protects the health and well-being of you and your family, which is why you must opt for the best insurer to ensure that the plan offers good and comprehensive coverage. This can be done through research. You may take some time out and do research on the different plans and compare them with similar plans offered by other insurers. This will help you in making an informed decision. The research you carry on helps you to understand the various aspects of your insurance plan to ensure that your loved ones receive the much-needed protection when required.

Top General Insurance Companies of Public and Private Sector in India 2024

A General Insurance Company is one that does not come under the domain of life insurance. The different types of general insurances available include, motor, fire, marine, etc. which come under the wing of miscellaneous non-life insurance.

The three main types of General Insurance in India are Health Insurance, Motor Insurance and Life Insurance.

Life Insurance offers coverage for a person's life, whereas General Insurance allows coverage to other things like assets. For example, health insurance, Motor Insurance, Travel Insurance and Home Insurance etc.

Below are some of the key General Insurance companies in India in the private sector:

Aditya Birla Health Insurance Co. Ltd.

Bajaj Allianz General Insurance Co. Ltd.

Bharti AXA General Insurance Co. Ltd.

Cholamandalam General Insurance Co.

Future Generali India Insurance Co.

HDFC ERGO General Insurance Co.

ICICI Lombard General Insurance Co.

IFFCO-Tokio General Insurance Co.

It is difficult to say which general insurance company is the best in India as it can vary based on individual needs and preferences. However, some of the top general insurance companies in India include:

#1 New India Assurance

#2 ICICI Lombard

#3 HDFC ERGO

#4 Bajaj Allianz

#5 SBI General Insurance

It is recommended to compare policies and services from different companies to determine which one is the best fit for you. It is also important to check the claims settlement ratio, financial strength and customer service of the company before buying insurance from them.

All kinds of insurance plans except for life insurance policies are categorised as general insurance policies. They are categorized into different policies like motor insurance policies, health insurance policies, travel insurance policies etc.

Life insurance policies allow death benefit to the nominee of the policyholder in case of death of the person and thus secures the lives of family members of a policyholder. However, no death benefit is offered by general insurance companies. Rather these policies allow the insured to raise claims for certain conditions.

There are various factors to consider before choosing a suitable insurance company to fulfil your needs. However, the very first thing is to verify the reputation of the company by checking its ratings and customer feedback. The next thing to follow is to check the CSR or claim settlement ratio of the insurer. And finally, you must check the premium levied on you for the chosen plan.

Author Bio

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Latest Post

Showing care and love towards your loved ones can come in different forms, and purchasing a family health insurance plan is one of them. While there are several benefits of purchasing a family health insurance plan, finding one that suits your family’s needs can be confusing. Let’s walk through the top family health insurance plans to give you an insight.

Health insurance has become a household name in recent years, especially after the worldwide pandemic outbreak. People have understood the importance of having health insurance the hard way. This has significantly enhanced its popularity.

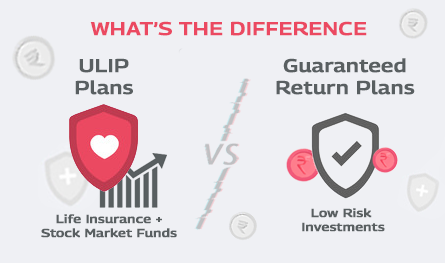

When it comes to financial planning, people often want to choose the best of both worlds: returns and security. If you have been looking for these two elements under one plan, then you would have come across ULIPs and Guaranteed Return Plans. While ULIP plans offer high returns, guaranteed return plans ensure stability and security. Which one is the most suitable for you? That's a topic worth discussing.

.png)

What about investing in a policy that promises the dual benefit of life cover and maturity benefit? That's exactly what an endowment policy does. All you need to do is save regularly to reap a lump-sum maturity benefit. Simultaneously, the policy also provides life cover to the assured. However, financial experts suggest that not every policy can be suitable for every financial goal.

When 29-year-old Shravan Kapoor planned to buy an endowment plan, he was quite sure he would be able to do that in a few minutes. However, when he opened the insurer’s website, he felt lost in the maze of endowment policies. Guaranteed returns, bonuses, maturity benefits, premium paying tenure, etc, all seemed a little too much to handle.