Term Insurance Premium – A Key Factor To Finding The Best Coverage

.png)

What is Term Insurance and Why it is so important now a days?

Term insurance has become a vital part of modern-day life. When you compare insurance plans, you will find that term insurance is the most affordable of them all. However, it is important to choose a term insurance premium that is as low as possible without compromising on life insurance coverage.

.png)

6 Factors that affect your term insurance premium and coverage

Here are the different factors that affect your term insurance premium and coverage:

1. Your age

This is perhaps the most crucial factor of them all. Insurers categorize the general population according to their age group and rates of mortality. The rate of mortality will determine the premium amount that is applied to your coverage. The older you are, the higher your premium amount will be. To make the most of your coverage, it is advisable to buy term insurance as early as possible to enjoy lower premiums.

2. Your residential region

Regional rates may vary which will impact the overall term insurance premium. For example, if your residential region is in a flood-prone or earthquake-prone area, then your insurance premium is likely to be higher. When you compare insurance plans, look for one that offers the best affordable premiums for your region.

3. Your gender

In general, it is considered that women have longer life spans than men. Due to this fact, a woman’s term insurance premium amount will likely be lower than a man even if they are of a similar age and share other similar factors.

4. Your occupation

Your occupation can have a major impact on your lifestyle and health. Some occupations are more physically taxing than others. Or your occupation could put you at a higher risk of danger than other occupations. Insurance providers categorize occupations into three groups:

- Category 1 includes specialized occupations such as a general surgeon

- Category 2 includes semi-skilled occupations that do not involve physical labour. Most corporate, aka desk jobs, fall into this category. These occupations have the least risk and so, typically enjoy the lowest premiums.

- Category 3 includes unskilled labour-intensive occupations in industries such as manufacturing or mining.

5. Health and lifestyle

If you want to enjoy lower premiums, then it may be time to give up or reduce habits such as drinking alcohol and smoking. These habits often impact your health and thus, to mitigate this risk, insurance providers increase the premiums for smokers and drinkers. A pre-existing health condition or a health condition that runs in your family such as diabetes will also result in higher premiums.

6. Additional riders

Riders are an additional benefit that can be availed on the payment of added premiums. For example, if you work in a high-risk occupation, you can avail of an Accidental death benefit rider or an accidental disability benefit rider. These riders will ensure that you and your family are taken care of in case of any major accident.

Author Bio

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Other Life Insurance Products

Latest Post

Showing care and love towards your loved ones can come in different forms, and purchasing a family health insurance plan is one of them. While there are several benefits of purchasing a family health insurance plan, finding one that suits your family’s needs can be confusing. Let’s walk through the top family health insurance plans to give you an insight.

Health insurance has become a household name in recent years, especially after the worldwide pandemic outbreak. People have understood the importance of having health insurance the hard way. This has significantly enhanced its popularity.

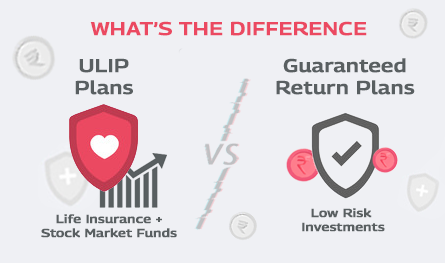

When it comes to financial planning, people often want to choose the best of both worlds: returns and security. If you have been looking for these two elements under one plan, then you would have come across ULIPs and Guaranteed Return Plans. While ULIP plans offer high returns, guaranteed return plans ensure stability and security. Which one is the most suitable for you? That's a topic worth discussing.

.png)

What about investing in a policy that promises the dual benefit of life cover and maturity benefit? That's exactly what an endowment policy does. All you need to do is save regularly to reap a lump-sum maturity benefit. Simultaneously, the policy also provides life cover to the assured. However, financial experts suggest that not every policy can be suitable for every financial goal.

When 29-year-old Shravan Kapoor planned to buy an endowment plan, he was quite sure he would be able to do that in a few minutes. However, when he opened the insurer’s website, he felt lost in the maze of endowment policies. Guaranteed returns, bonuses, maturity benefits, premium paying tenure, etc, all seemed a little too much to handle.