The insurance industry will experience three defining future trends, which include artificial intelligence innovation, next-generation computing, and human-machine collaboration by 2025. Insurers must acknowledge these market trends to successfully address modern customer demands and industry competitors.

AI’s Expanding Role in Insurance

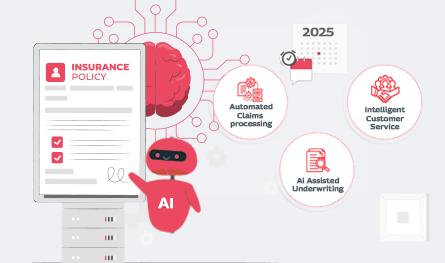

Modern insurance operations rely on artificial intelligence to optimise business operations, improve service quality, and enhance risk management capabilities.

1. Predictive and Generative AI for Smarter Insurance

Insurers now use AI extensively to optimise their operations as almost all major insurance companies have implemented AI-based solutions across their business strategies. The transformation of critical insurance standards is driven by AI implementation.

- Automated Claims Processing: The assessment of claims through AI tools allows insurers to process claims faster, which reduces employee workload and speeds up payment processes.

- Intelligent Customer Service: AI chatbots and virtual assistants deliver immediate answers to customer questions, resulting in better service quality.

- AI-Assisted Underwriting: AI risk factor evaluation generates superior results, which enables insurers to create better pricing models and policy suggestions.

Through machine learning algorithms, AI helps detect suspicious transactions to minimise financial losses.

2. Managing AI Risks and Ethical Considerations

The extensive advantages of AI programmes come with limitations like privacy risks from data collection and biased algorithm operations. Insurers need to use explainable AI models as these systems stimulate transparent decision processes which help reduce automated process biases. Regulatory organisations mandate fair AI practices to provide consumers with accurate and ethical policy evaluation results.

New Frontiers in Computing and Data Processing

Insurance organisations implement advanced computing technologies to perform better risk evaluations, customise coverage plans, and boost operational effectiveness.

1. Hybrid Computing and IoT Integration

Insurers who adopt hybrid computing systems, uniting cloud-based and on-premise solutions, can efficiently process their large datasets. Real-time customer behaviour analytics is made possible through the implementation of the Internet of Things (IoT) system.

- Usage-Based Insurance Models: Vehicle telematics and wearable health trackers employ IoT devices. It helps insurers create customised insurance policies through behaviour analysis.

- Enhanced Risk Modelling: Through the IoT device data collection, insurers gain the ability to foresee and prevent risks before they materialise.

2. Emerging Technologies: Quantum Computing and Neuromorphic AI

Quantum computing and neuromorphic AI are in their early development stage. However, the technologies demonstrate great promise to change the insurance industry. The combination of these technologies would enhance data speed, improve risk assessments, and speed up claim processing. Quantum computing technology enables insurers to analyse extensive risk datasets within seconds, resulting in the most efficient risk assessment capabilities ever achieved.

The Growing Synergy Between Humans and Machines

The growing sophistication of human-AI system collaborations through technological advancement influences better decisions and operational efficiency.

1. Data-Driven Underwriting for Enhanced Customer Experience

Underwriting platforms integrate artificial intelligence analytics to improve risk evaluation processes while creating bespoke policy solutions. Insurers now use:

- Automated Data Collection: APIs and blockchain technology enable the smooth acquisition of data across various sources while eliminating paperwork and human handling steps.

- Predictive Risk Modelling: AI technologies evaluate market patterns to identify upcoming dangers, enabling insurers to create adjustable premiums and customised policy suggestions.

2. Strengthening Supply Chain Risk Management

Insurance companies implement sophisticated data analytical methods to protect supply chain operations, support ongoing business function, and improve financial health. The application of real-time data enables insurers to detect upcoming supply chain interruptions, allowing them to develop proactive measures for reducing financial losses.

.png)