How To Find LIC Policy Number – Things Required to Find LIC Policy Number Online and Offline

When you buy a policy, you must have the details related to your policy such as the policy number and other important information. Like other insurers, LIC allows its policyholders to find policy details in different ways including online and offline methods. LIC is one of India's most trusted and sought-after insurance companies for policyholders from remote and urban areas. Hence, LIC makes it easy for everyone to check policy details easily and smoothly as discussed in this post.

How to Check Policy Number?

Having bought a LIC policy means you have planned for your financial security. But things may come to a standstill if you forget the LIC policy number. However, there is nothing to worry about regarding how to get the LIC policy number, because there are ways to get it. Let us discover these methods to find your LIC policy number:

Online Method to Find Your LIC Policy Number

The internet has simplified multiple things for us, take for instance, finding our LIC policy number. Following is the best and easiest way to locate your lost LIC policy number online:

- Use the LIC Portal: Remember when you purchase a LIC policy, you are asked for some credentials and details. These details are used to create an online account on the LIC portal. Use this same information to find your LIC policy number by logging into the LIC official portal.

Offline Methods to Find Your LIC Policy Number

How to know the LIC policy number if you are unable to opt for the online method? There are not one but three different offline methods for the same. Have a look:

- Visit the Home Branch: The best offline method to find your LIC policy number is by visiting the LIC home branch. Take along your PAN card and other essential ID proofs while visiting the home branch. These details will be used by the LIC officials to complete the verification and then the LIC staff will provide you with your LIC policy number.

- Visit Nearest LIC Branch: In case, you are not able to locate the home branch of LIC or visit it. Then, visit any nearest LIC branch and you may request the officials to give you your policy number. Here too, don’t forget to take along your PAN card and other ID proofs.

- Contact Your LIC Agent: If you have forgotten your LIC policy number, then the only person, your LIC agent can help you recover your policy number. All you need is to provide the agent with the policyholder’s name along with his/her date of birth.

Finding LIC Policy Number by your Credentials like Name and Date of Birth

LIC is one of the popular insurance companies in India offering products for policyholders to invest in to enjoy continued protection. The LIC policy number is an important proof of your policy and is required in many instances. However, many people lose the policy document by mistake, thereby losing the option to track the policy.

On the other hand, sometimes parents buy LIC policies for children without informing them. In most cases, it happens because they buy policies when the children are still very young. Hence, children may not be aware of the policy document if the parents die suddenly and may not be able to raise a claim.

In such cases, you can avail of the policy number in a hassle-free manner by visiting the LIC official portal. A policyholder can use the correct credentials like name, and date of birth (DOB) to retrieve the policy number. These credentials should match with the information provided at the time of buying the policy.

Things Required to Find LIC Policy Number

There are times when people who purchase a LIC policy forget their policy number. They either forget to keep the documents safe or forget to note down the policy number somewhere. So, in that case, these two vital credentials can help you retrieve your lost LIC policy number:

- Policyholder name

- Date of birth

How to Check LIC Policy Status Without Policy Number

There are a couple of things you can do to check the LIC policy status without a policy number. Have a look to understand these easy steps to check your LIC policy status without using your policy number:

- Firstly, you can contact your LIC agent and give a few details to get updates about your policy status.

- The second option is to visit the nearest LIC branch from where you bought the policy and fulfill the requirements asked by the officials to get your policy status.

- The third way to check the LIC policy status without your policy number is by contacting LIC customer care by dialing 1251 from your registered mobile number.

Things to do to Avoid Losing/Misplacing Your Policy Documents

It is better to keep the policy information safe so that it can be retrieved easily without having to go through complex processes. Here are some tips to follow for the same:

- Keep your important documents in a single file including policy documents of your LIC policy. This will prevent your documents from getting lost.

- Buying a policy online is another solution here. Your digital account stores all the information regarding your policy online and helps you locate them whenever required.

- Always update any change in the policy such as email, address, contact number, etc. Keep the insurer updated about the changes too.

- Inform your family about all the policies and their details to ensure safety.

FAQs on How To Find LIC Policy Number?

Consider buying any of the following LIC policies in 2023 for the best returns:

LIC Jeevan Amar

LIC New Jeevan Anand

LIC Jeevan Umang

LIC Jeevan Shiromani

LIC New Endowment Plus

LIC New Children’s Money-back Plan

Only your LIC agent can help you find your LIC policy number by name. Along with the name, you will also need to provide your date of birth to find the LIC policy number.

To check your LIC policy details online, you need to follow these steps:

Visit the official LIC portal

Click on the “Login to Customer Portal”

Select “New User”

Click on the “Sign Up” option

Register by filling in the required details and get access to your LIC policy number and other policy details

Try these steps to get your LIC policy number by SMS:

Open your mobile

Click on “Compose SMS”

Type ASKLIC xxxxxxxx STAT

Send this SMS to 56767877 or 9222492224

You will immediately receive your LIC policy live status and not just the policy number

You will get an error message if you send this message from an unregistered mobile number

The following steps can help you download your LIC policy copy:

Visit the LIC Life Insurance office portal

Click on the “Login to Customer Portal”

Fill in the essential details like policy number, email ID, and date of birth

Click on the “Proceed” option

You can easily check your LIC policy number without registration with these steps:

Visit the office LIC Life Insurance online portal

Click on the “New User” tab

Choose your user ID and password

Enter all the required information

You will now become a registered LIC portal user

Author Bio

Paybima Team

Paybima is an Indian insurance aggregator on a mission to make insurance simple for people. Paybima is the Digital arm of the already established and trusted Mahindra Insurance Brokers Ltd., a reputed name in the insurance broking industry with 17 years of experience. Paybima promises you the easy-to-access online platform to buy insurance policies, and also extend their unrelented assistance with all your policy related queries and services.

Other Life Insurance Products

Latest Post

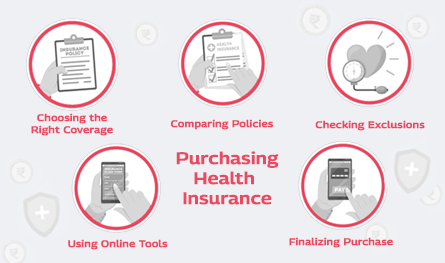

Considering the steep inflation in the medical and healthcare sector, having health insurance has become a must-have for every household. The absence of a reliable health plan will not only deplete your hard-earned savings but will add to your stress, too. The pandemic outbreak has revealed the importance of health plans the hard way.

Nobody can surely predict the future, but reliable health insurance can protect it well for sure. Uncertainty is the very essence of life; the 2020 pandemic outbreak has taught it the hard way. Securing your and your family’s health is a matter of responsibility and concern rather than that of luxury.

Health insurance acts as a protective shield for you and your family members, offering financial protection against medical emergencies. Considering the steep inflation rate in the healthcare sector, a few days of hospitalisation is enough to deplete a significant portion of your savings, especially if it involves a surgical procedure of any sort.

In today’s time, when medical inflation is at an all-time high, it has become a necessity to purchase a robust health insurance plan. Whether it is an emergency hospitalisation or treatment for a critical illness, health insurance plans are there to help.

When it comes to choosing a health insurance plan, there are typically two options: indemnity health insurance and fixed benefit health insurance. The indemnity health insurance plan is a more popular option; let’s understand why.

Taking control of your health means more than just reacting to illness; it means proactively safeguarding your well-being. With the escalating costs of medical care, a comprehensive health insurance policy is no longer optional—it's vital.

.png)

Everyone looks at getting knowledge about different kinds of insurance plans. However, people hardly consider seeking awareness about the rights of insurance policyholders. Let us discuss them in this post.